Fed's Waller will be speaking at 2:35 PM ET.

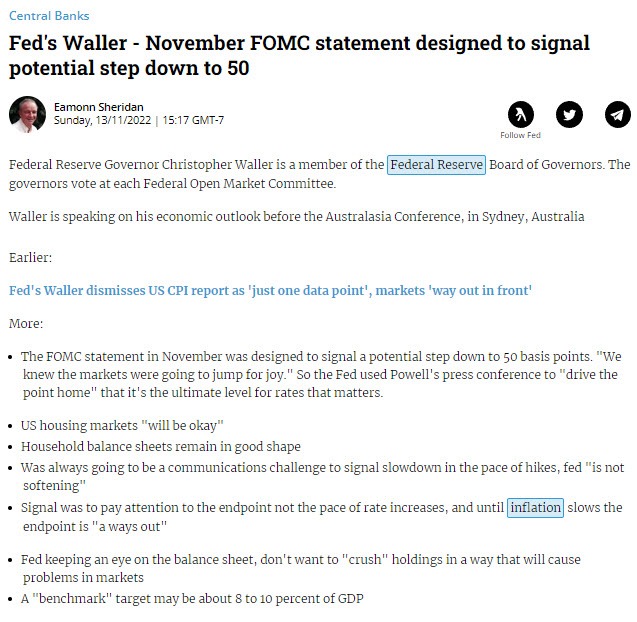

Recall he threw cold water on the markets over the weekend when he said that the CPI was just one data point, and that the "markets were way out in front"

Fed's Waller will be speaking at 2:35 PM ET.

Recall he threw cold water on the markets over the weekend when he said that the CPI was just one data point, and that the "markets were way out in front"

Most Popular

Sponsored

ANZ says rising OPEC+ output & lower refinery runs will lift crude inventories & keep Brent below $65/bbl in 1H 2026. A supply surplus limits upside, but geopolitical risks should keep prices above $60, global growth later pushing Brent toward $70

The headline about what BoJ Ueda said is missing the much bigger point (hint, rate hikes) BOJ weighs next hike with little clarity on terminal rate, Ueda says

Japan’s 30-yr JGB sale draws highest demand since 2019 as bid-cover surges. A tighter tail and high bid-cover ratio may help anchor Japan’s long end as markets weigh the BOJ’s next policy move.

Taiwan eyes $300B+ US chip investment; Taiwan dollar steady, traders watch for concrete numbers.

Dominion Energy (D) yields 4.25% with Fwd P/E 18.4x, eyeing AI data center growth. Steady returns, not a moonshot.

JPMorgan upgraded Chinese equities to overweight, chance of a major rise in 2026 outweighs downside risks. Sees 19% upside for MSCI China: AI growth, “anti-involution” margin gains, stronger shareholder returns & domestic liquidity

Bank of Japan Governor Ueda says current monetary policy conditions are still accommodative, even after recent adjustments, suggesting further tightening remains possible but not pre-determined.

Sponsored

Must Read