Nick Timiraos at the Wall Street Journal says the Federal Open Market Committee (FOMC) 'wait and see' approach to rate cuts "has undergone an important reset because of the threat of an expansive trade war that sends up prices."

- The Fed can cut because of good news—inflation has declined—as was the case last year.

- Officials can also cut because of bad news—the economy is sputtering.

- The case for the first type of cuts has dimmed ... Tariffs represent an economic shock that can suddenly decrease the economy’s ability to supply goods or services, sending up prices while weakening economic growth.

Link here (gated):

***

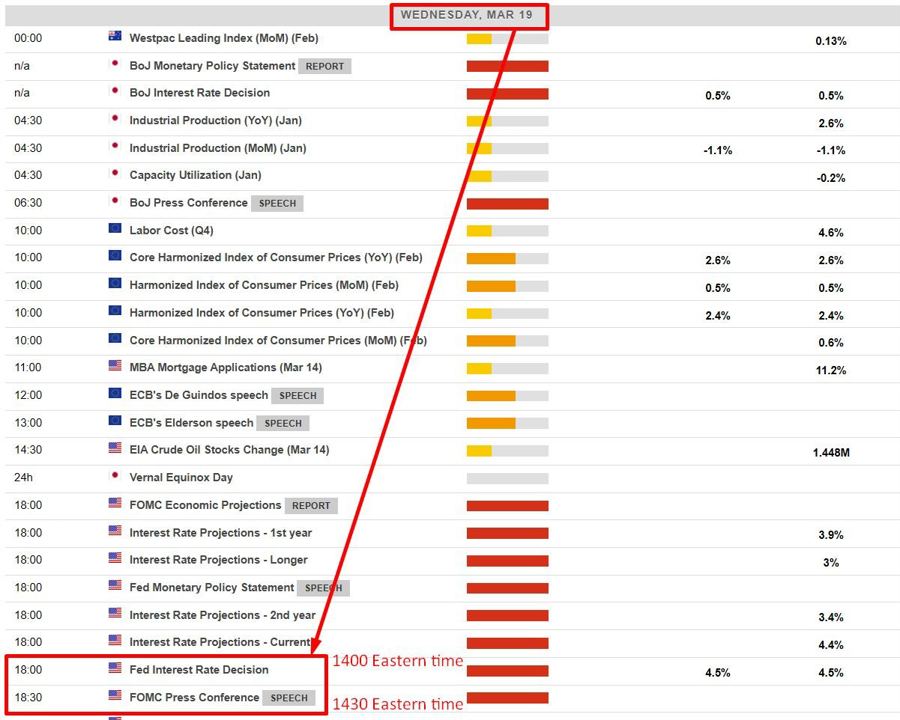

The Fed statement due Wednesday, March 19, 2025 is expected to leave rates unchanged: