Comments in an essay from Bostic:

- continues to view price stability as the most pressing risk facing FOMC

- it is unclear whether the labor market is significantly out of balance

- Expects inflation to remain above 2.5% even at the end of 2026.

Sees little to suggest price pressures will dissipate before mid-to-late 2026 at the earliest.

"Aggressive monetary policy response" is not warranted for current labor market conditions.

Moving policy near or into accommodative territory risks exacerbating inflation and untethering expectations.

Employment market is, at best, moving sideways; likely conditions are softening but not at a negative inflection point.

GDPNow model estimates for Q3 are holding north of 3%; does not view severe downturn as likely.

Notes that the recent Dec cut vote included three dissents; calls it a "close call."

Will retire in February 2026.

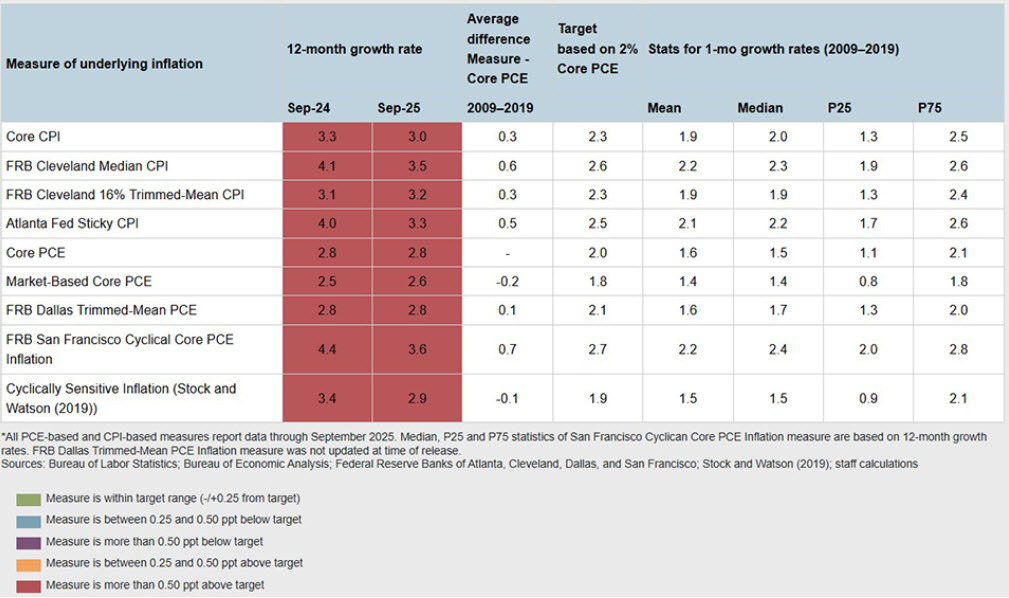

He highlighted this table with his inflation concerns.

Here is a key line:

If underlying inflationary forces linger for many months to come, I am concerned that the public and price setters will eventually doubt that the FOMC will hit the inflation target in any reasonable time frame. Will the public lose faith after five years of above-target inflation? Six years?

He didn't have a vote in December but there's a good chance he was arguing against rate cuts. All that said, he will only attend one more meeting before retiring. His replacement will be a voter in 2027.