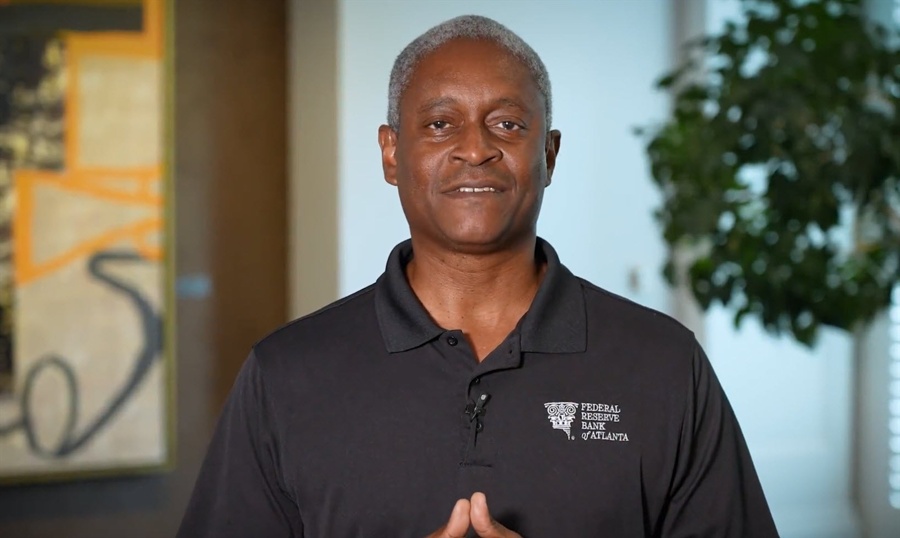

Federal Reserve Bank of Atlanta President Raphael Bostic speaking on monetary policy in a moderated conversation hosted by Emory University, in Atlanta, Ga:

- Right now range of possible outcomes has multiplied

- Boundaries of what I thought could be possible have been blown up

- Labor market is effectively at full employment

- Says inflation still much higher than target

- Not in a position to move boldy in any direction

- Need more clarity

- the fog has gotten really thick

- economy in a big pause

- businesses and households not confident on making big investments

- tariffs mean prices are likely to go up, so the timing of reaching the inflation target is likely to be pushed out

- see growth over 1% this year

- where economy will land depends on where administration policy lands

- moving boldly with policy wouldn't be prudent

- Reduction in immigration is affecting labor market for construction and some sectors, but no broad effect

- Boosting manufacturing in the US will take more than putting up walls, would take engineering

These are confronting remarks from Bostic.

On the one hand he is wary of cutting:

- labor market is effectively at full employment

- inflation still much higher than target

And on the other hand is is aware of the damage being done to the US economy::

- economy in pause

- hesitancy on big investments