- Prior range was 4.25-4.50%

- No change to rates was 99% priced in

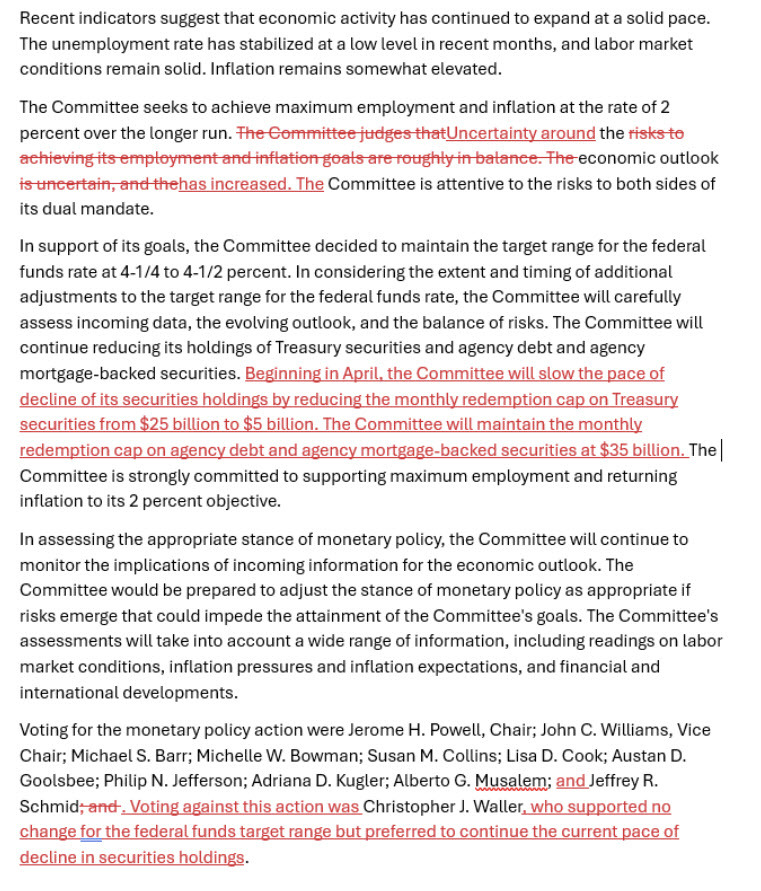

- Says "uncertainty around the economic outlook has increased"

- Removes line in the statement that said 'risks to the outlook roughly in balance'

- Labor market conditions remain solid

- Inflation remains somewhat elevated

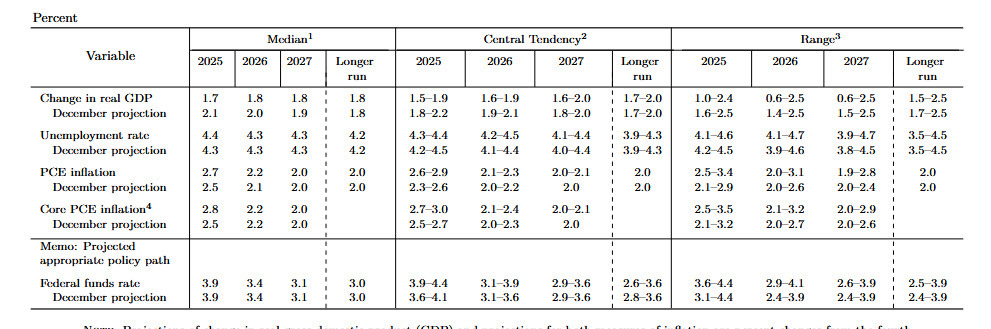

- GDP forecast this year to 1.7% from 2.1%

- Beginning in April, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion (Waller dissented to this)

- The Committee will maintain the monthly redemption cap on agency debt and agency mortgage-backed securities at $35 billion

- Dots continue to show two rate cuts this year

Reversing a big portion of the QT may be seen as dovish.

Prior to the decision, the market is pricing in 55 basis points of Fed easing this year (60 bps afterwards). USD/JPY was trading at 149.92 ahead of the data. There has been a dovish initial reaction down to 149.60 with some modest buying in stocks and bonds.

The change to uncertainty from 'roughly in balance' highlights a wide range of outcomes on fiscal policy and tariffs.

Here is the redline:

Here are the forecasts:

There were some changes here but I don't see them as any big surprise. I would highlight the wider ranges of forecasts and outcomes.