ICYMI my heads up on this from earlier in the week:

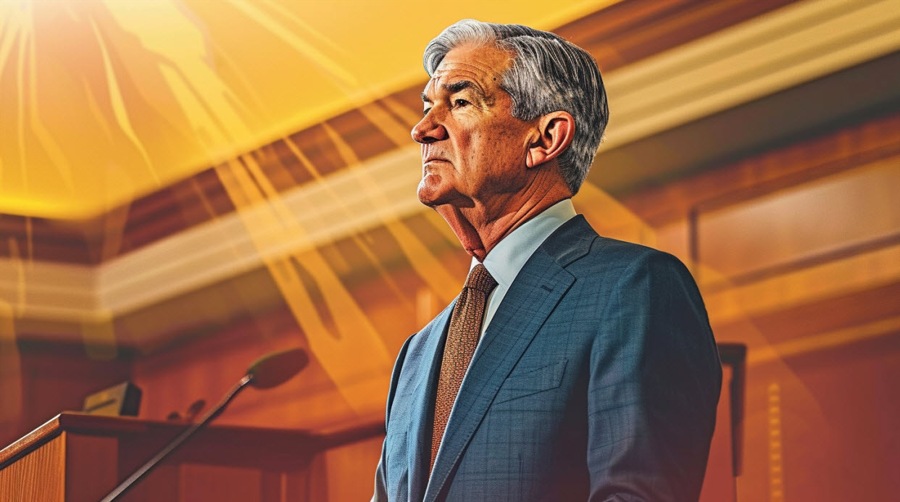

Federal Reserve Chair Powell is heading to Congress on Wednesday and Thursday to present one of his twice-a-year testimonies.

First up will be his appearance before the House Financial Services Committee on March 7:

- at 10 am Washinton time (US Eastern time)

- 1500 GMT

This is colloquially known as the Humphrey-Hawkins testimony. It's a biannual report delivered by the Fed Chair to the Congress.

In it the Fed reports on its monetary policy and economic goals to the Congress.

Powell will:

- provide an overview of current economic conditions, and give an update of the Fed's outlook for the economy, centring on an assessment of the inflation and employment outlook

- will discuss the Fed's monetary policy position currently, including its changes in interest rates

- take questions from members of Congress, which will cover a range of topics across areas such as how specific economic sectors are faring, regulatory policies, and global economic issues

Adding in a snippet from BMO now on what they are looking for:

- While a ramp-up in hawkishness is a justifiable outcome based on sticky inflation, relatively easy financial conditions, stable growth and a healthy labor market, we struggle to imagine a significant shift [by Powell] from other policymakers’ recent guidance

- That said, by simply messaging the Fed funds rate will be held at 5.33% for the foreseeable future and framing January’s hot inflation data as no more than a bump in the path toward 2% (i.e. downplaying its relevance), Powell will most likely be interpreted as less hawkish than one might have otherwise assumed.