The Fed is widely expected to cut interest rates by 25 bps bringing the policy rate to 3.75-4.00%. The central bank is also expected to announce an end to QT. We won't get the SEP at this meeting, so the focus will be mostly on the Press Conference where Fed Chair Powell is expected to frame the rate cut as a risk management move once again and keep the status quo in terms of expectations by not giving much away amid lack of key economic data.

STATEMENT

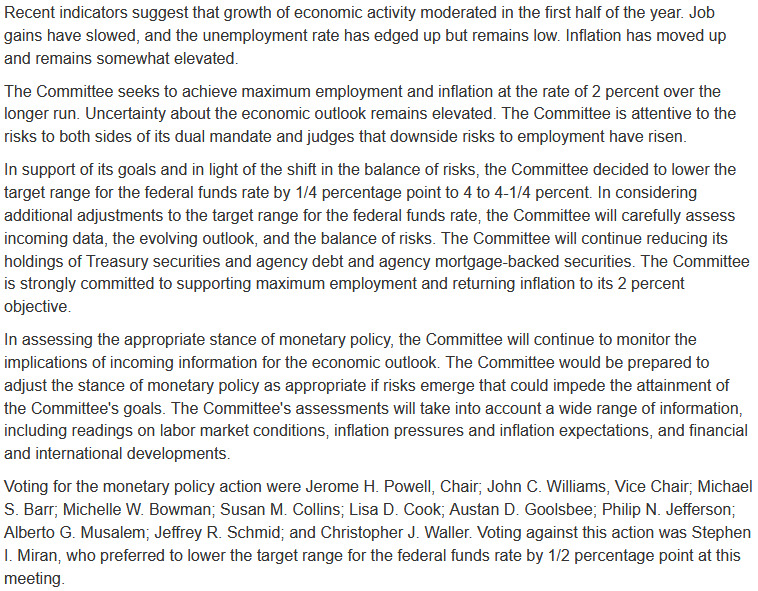

The statement could see some revisions which wouldn't be surprising. The first two paragraphs, will likely be revised to acknowledge a pick up in economic activity. The part about employment and inflation will likely remain unchanged (although the "moved up" on inflation could be scrapped). We might also see them mentioning lack of government data amid the shutdown causing uncertainty.

In the third paragraph, the target range will of course be revised to reflect the rate cut. The QT part is where we should see the biggest change as the Fed should signal an end to quantitative tightening either at this meeting or the next.

In the last paragraph, we should see Miran dissenting and voting for a 50 bps cut. There is also a chance that we see Schmid dissenting for a hold although it wouldn't be surprising since he's one of the most hawkish voters.

PRESS CONFERENCE

The press conference is where we should get the real action. Now, the base case is for Fed Chair Powell to keep the status quo amid the lack of government data and not giving much away in terms of forward guidance. The only thing that could surprise the market is if he sounds uncertain about a December cut. The market is 100% sure on a December cut, so if he casts doubt on that, it will likely be taken as a hawkish surprise. (read here why that might happen)

The reaction in the markets to a hawkish surprise should be kind of straightforward: US stocks should fall and might erase the rally since Monday. Treasury yields should rise, with the short-term yields rising faster than long-term ones. The US dollar should strenghten considerably. And precious metals like gold and silver should drop to new lows.

If he doesn't sound uncertain on a December cut, then things should remain the same and the markets should keep moving based on the positive sentiment triggered by US-China deal.

MARKET PRICING

- October cut: 100% probability

- December cut: 100% probability

- Total easing by the end of 2026: 117 bps (vs 75 bps projected by the Fed)

Before you scroll past another headline — get the Fed in plain English.