- Business response to what appeared short term supply and other problems could change long-run path of inflation

- businesses seeking redundant suppliers to buffer against future disruptions. That is adding to costs

- if current levels of Fed support are left in place, it could fuel more inflation. Warrants action soon to reduce accommodation

- goal of coming policy action is to ensure expectations about inflation don't become on tethered

- a real danger is if expectations drift from 2% target to 4% or higher

- pandemic induced price changes could grind on long enough to fundamentally altar how the public thinks about inflation

- we will be watching monthly changes in inflation to see if they decline, but ready to support more aggressive steps if the pace increases.

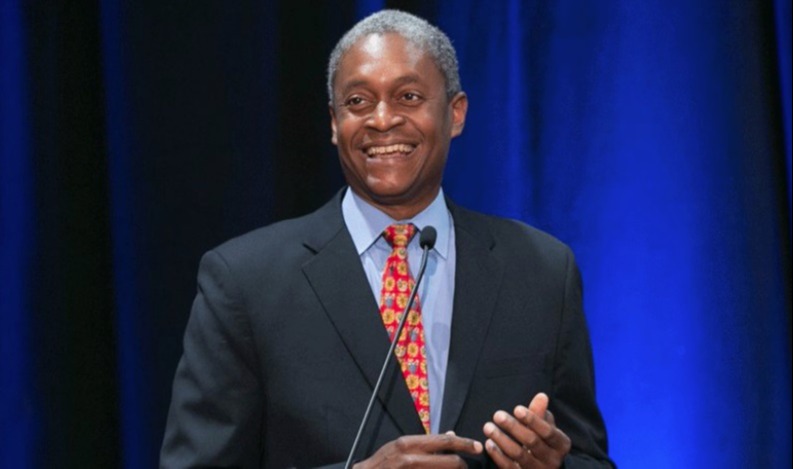

Feds Bostic spoke yesterday as well. You can find his comments HERE.

The US dollar has been coming off of its lower levels a bit in the New York session. US stocks have now turned negative with the Dow down about -8 points, the S&P down -11 points and the NASDAQ index down -66 points.

Spot gold is up $7.62 at $1804.32

WTI crude oil futures are trading near unchanged at $88.15.