A 50bp European Central Bank rate hike at the next meeting (March 16) appears to be locked in. this the latest from one of the Bank's talking heads:

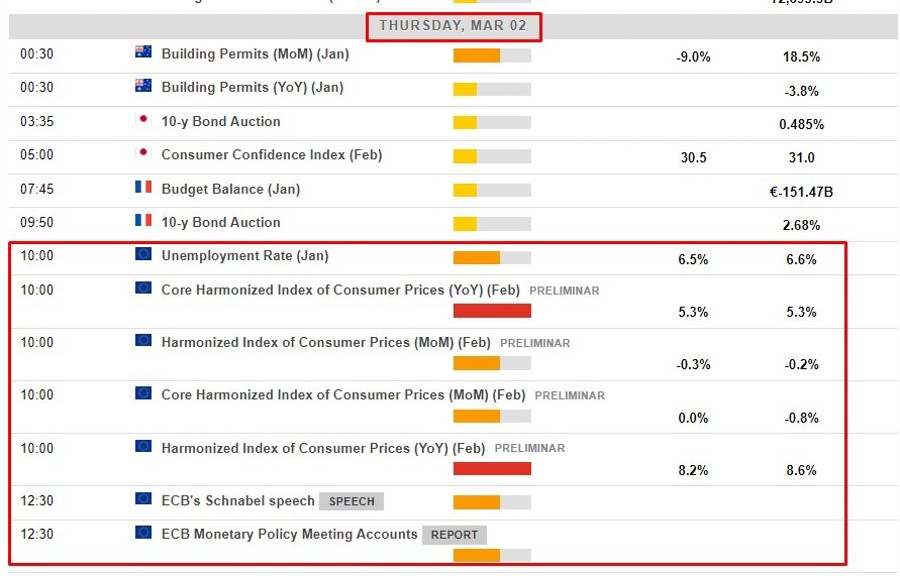

Ahead of that meeting will be the inflation data for February,. Its not due until Thursday this week, so by all means file this post away until then.

Analysts at UniCredit Research are expecting the y/y rate to drop sharply (this is market consensus also). They then add

- "market participants might pay more attention to the expected 0.4% increase on a monthly basis when the data are released on Thursday"

The analysts say that this was the lesson learned from the most recent US inflation release, where the monthly spike was much more relevant than the disinflationary trend in the on-year change.

This snapshot above is from the ForexLive economic data calendar, access it here.

The Wall Street Journal poll has expectations for the harmonized index of consumer prices (HICP) to rise 0.6% m/m & 8.2% y/y.