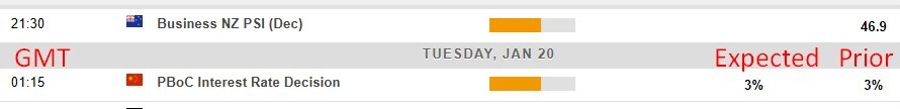

It's a light data agenda for the session here in Asia-Pacific on Tuesday, January 20, 2026.

Kicking it off is the services PMI from New Zealand, the BusinessNZ Performance of Services Index for December 2025. Last week we had the December manufacturing PMI (BusinessNZ Performance of Manufacturing Index):

Summary:

New Zealand’s manufacturing PMI rose to 56.1 in December, the highest since December 2021

All five sub-indices expanded, led by a sharp rise in new orders and production

Employment returned to growth after earlier declines during 2025

Seasonal demand helped, but confidence, exports, and infrastructure work also supported activity

BNZ sees upside risk to near-term GDP growth from the stronger PMI print

There is no survey of expectations for the services PMI but given the leap higher for manufacturing it seems safe to look for improvement back into expansion. If so it should be another positive for the NZD. Famous last words?

Around the same time as we get the People's Bank of China setting the USD/CNY reference rate for the session we'll get the Bank setting its Loan Prime Rates (LPRs). This used to a big deal, very highly anticipated, but not any more. However, China's main policy rate is now the reverse repo rate, currently at 1.4% for the 7-day. The 7-day rate serves as a key policy benchmark, influencing other lending rates like the Loan Prime Rates (LPRs). The PBOC uses reverse repo open market operations to inject or absorb funds, influencing interbank lending rates.

The LPR setting in December left the 5 year at 3.50% (vs. expected 3.50% and prior 3.5%)

- and the 1 year at 3.00% (vs. exp. 3.0% and prior 3.0%)

There is no change expected for either again today. This will mark the eighth consecutive month without a change.

A look back at the past changes in the LPR, since early 2022:

| Date | One-year LPR | Five-year LPR | Change | Notes |

|---|---|---|---|---|

| May 2025 | 3.00% | 3.50% | -10bp | Latest cut; both 1Y and 5Y trimmed. |

| Feb 2024 | 3.45% | 3.95% | -25bp (5Y only) | Big mortgage-linked cut aimed at property sector support. |

| Aug 2023 | 3.45% | 4.20% | -10bp (1Y), -15bp (5Y) | Coordinated easing to counter weak growth. |

| Jun 2023 | 3.55% | 4.20% | -10bp (1Y), -10bp (5Y) | First LPR cut since Aug 2022. |

| Aug 2022 | 3.65% | 4.30% | -5bp (1Y), -15bp (5Y) | Targeted mortgage support. |

| Jan 2022 | 3.70% | 4.60% | -10bp (1Y), -5bp (5Y) | Part of early 2022 easing cycle. |