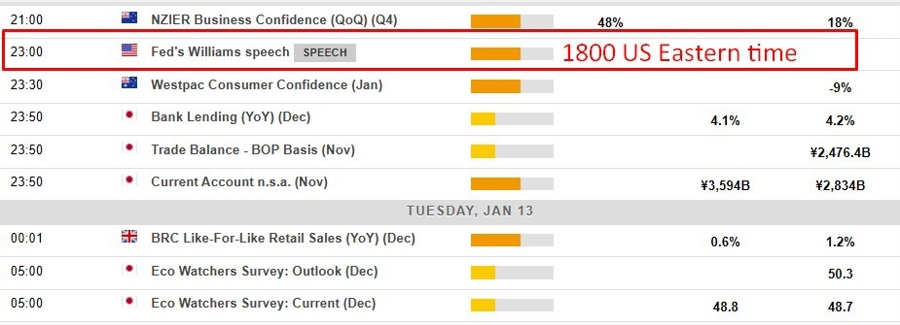

Eyes and ears open for New York Fed President John Williams speaking.

Williams is perceived as a close ally of Federal Reserve Chair Powell.

Scheduled to give keynote remarks at a Council on Foreign Relations event starting at 6 p.m. US Eastern time.

Japanese markets reopen today after a long weekend. The latest news from Japan of note is political:

- ICYMI: Japan's PM Takaichi is considering calling a snap election for mid-February

- Takaichi’s objective in calling a near-term election would be to secure a stronger governing mandate. For traders and investors, the more immediate implication is the prospect of even greater fiscal support under her administration. The market read is negative for both JGBs and the yen, given Japan’s already extreme public-debt burden and rising debt-servicing costs as the Bank of Japan gradually edges rates higher.

- This snapshot from the investingLive economic data calendar.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the 'prior' (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

---

We've already had the data from New Zealand, that has given NZD a lift:

In brief:

Business confidence in New Zealand has jumped to its strongest level in more than a decade, according to the latest Quarterly Survey of Business Opinion (QSBO) from New Zealand Institute of Economic Research, adding to evidence that the economy is emerging from a prolonged slowdown as lower interest rates begin to flow through.

Improved sentiment is translating into stronger intentions. A net 22% of firms plan to increase staff numbers in the next quarter, while investment plans for buildings and plant have turned positive after being negative in the September quarter. There are also early signs spare capacity is beginning to shrink, with a small increase in firms reporting difficulty finding skilled labour.

Overall, cost and pricing indicators suggest inflation pressures remain contained. With demand improving but spare capacity still evident, NZIER expects no further OCR cuts, forecasting the policy rate to trough at 2.25% before the Reserve Bank of New Zealand begins tightening in the second half of 2026.