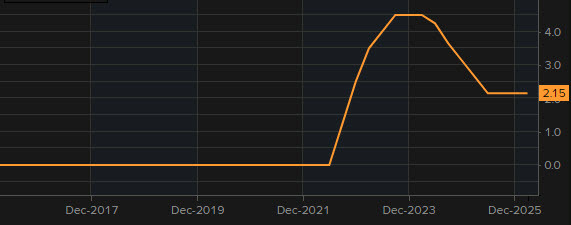

This comment is no surprise to the market, which is pricing in about a 20% chance of a rate cut this year. However I think it's the first time a top ECB official has said the "extended period" line.

Rates are right in the middle of the range of the past decade and that gives them room to shift in either direction.

Today we saw Germany's economy ministry lower its forecast for growth this year to 1.0% from 1.3% so I wouldn't say they're out of the woods yet. At the same time, growth in much of Europe was stronger last year and that led to a solid year for the euro.

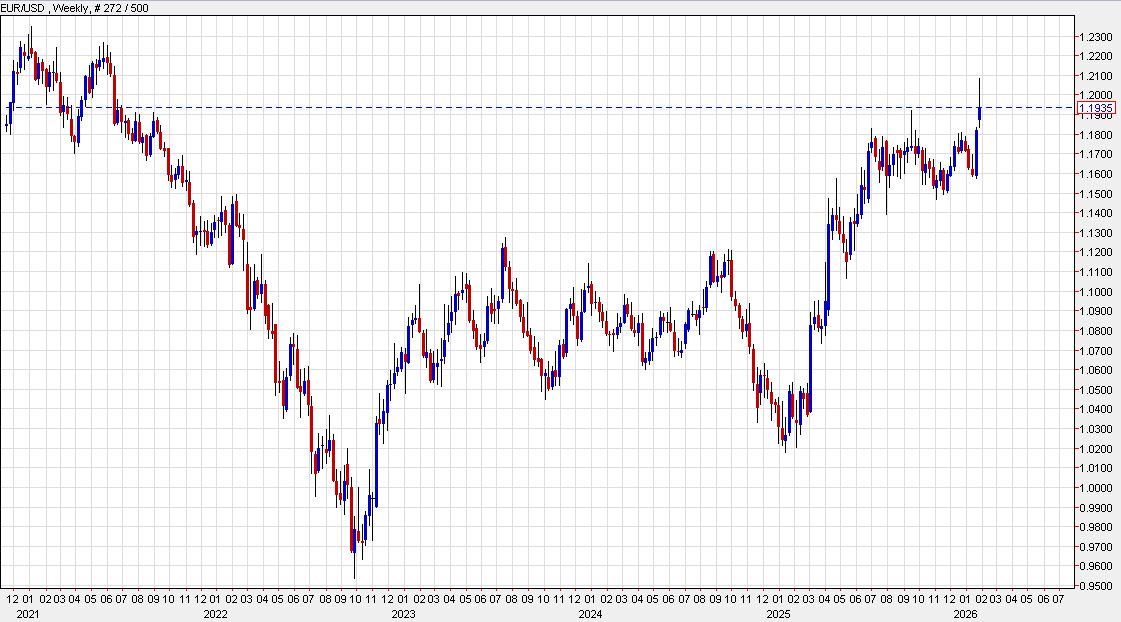

Those gains continued with it rising yesterday to the best levels since 2021 before giving back 100 pips today.

I think it's safe to see the ECB on the sidelines but earlier today, the ECB's Martin Kocher said the currency could be a factor. He said the European Central Bank would need to consider another interest rate cut if further increases in the value of the euro start affecting inflation forecasts.

The caveat to that was he said the recent gains were 'modest' and didn't need a response.

“If the euro appreciates further and further, at some stage this might create of course a certain necessity to react in terms of monetary policy,” he said.

The main move in the euro is against the dollar as the US currency broadly depreciates on geopolitical concerns and with the Federal Reserve still in an easing cycle. Later today, we get the FOMC decision and that should offer some additional hints on where US rates are headed.

The euro was last down 112 pips to 1.1929. The FOMC decision is at 2 pm ET.