ECB's Kazaks is saying that:

- It may be the case that the next rate move could easily be a hike as a cut.

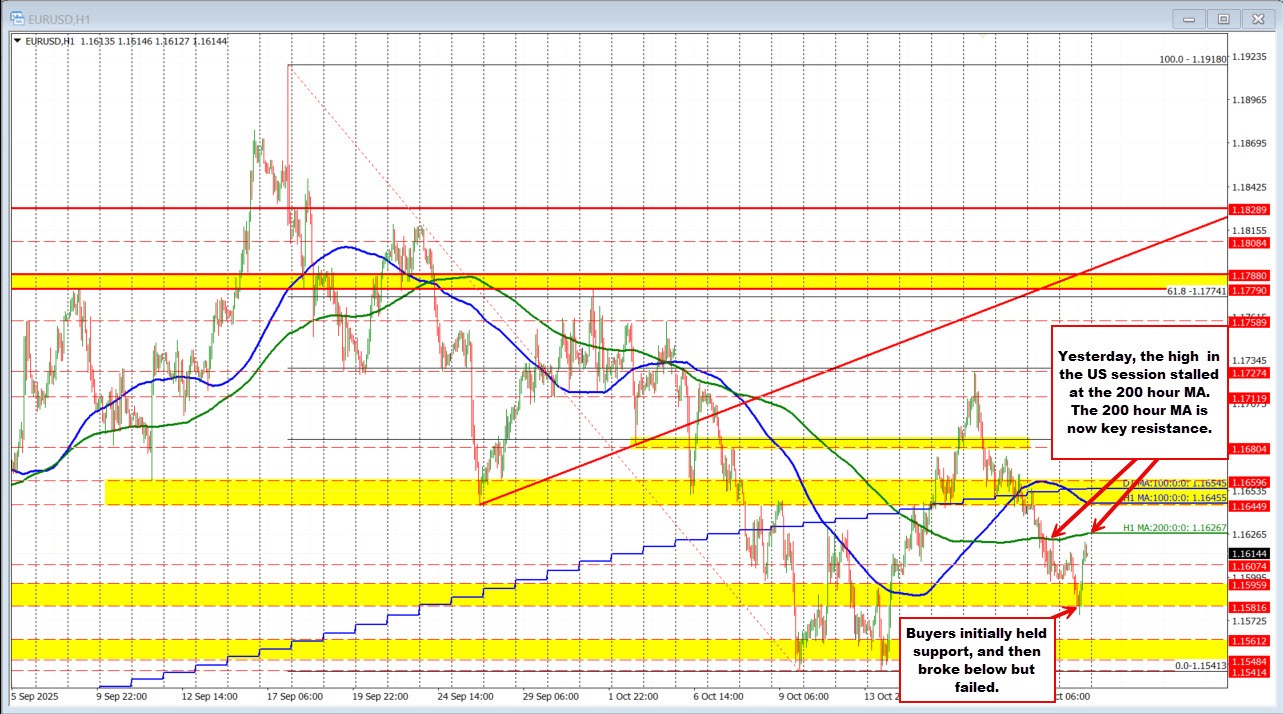

The EURUSD has erased its earlier declines and is now trading higher as the U.S. session unfolds. Earlier in the day, the pair dipped below a key swing area between 1.1581 and 1.15956, reaching a session low of 1.1578. However, the move lower failed to gain traction, and once the price reclaimed that support zone, sellers were forced to cover, helping fuel a steady recovery through the New York morning.

Momentum accelerated as the pair moved above the prior session high at 1.1615, extending to a new intraday peak of 1.1622. The rally has brought the EURUSD within striking distance of the 200-hour moving average, currently at 1.16267—a level that remains a key pivot point for the next directional move.

From a technical perspective, a sustained break above the 200-hour MA would give buyers more control and shift short-term bias to the upside, while simultaneously giving sellers cause for caution. On the flip side, if the price fails to hold above 1.1615–1.1622, traders may see the pair drift back toward the 1.1595–1.1580 support zone, where buyers have recently been willing to step in.

For now, the battle line is drawn around 1.1627—a break above strengthens the bullish case, while failure there risks reestablishing the broader consolidation seen over recent sessions.