Summary:

ECB sees no near-term case for changing interest rates if baseline holds

Current policy is expected to anchor rates for several years

Lane warns Fed policy missteps could pose external risks

Dollar volatility and U.S. inflation are key watch points

Euro zone growth improving cyclically but structurally constrained

The European Central Bank sees no reason to revisit interest rates in the near term, with current policy settings expected to form a stable baseline for the next several years, provided the euro zone economy continues to evolve broadly as forecast. That message was reinforced by ECB Chief Economist Philip Lane in comments to Italy’s La Stampa, reported by Reuters.

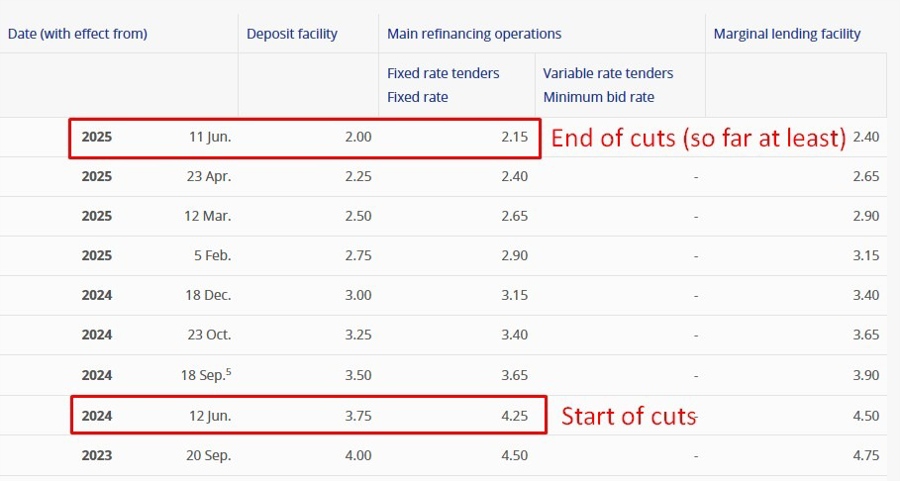

Lane said the ECB would not even be debating a rate change if its baseline outlook holds, citing resilient economic growth and inflation that appears to be stabilising around the central bank’s 2% target over the medium term. The ECB has kept rates unchanged since concluding a rapid easing cycle in June and has signalled little urgency to adjust policy again.

However, Lane warned that external shocks, particularly those originating in the United States, could complicate an otherwise benign outlook. He pointed to the risk that U.S. inflation may fail to return to target, or that financial conditions in the U.S. could spill over into global markets via higher term premiums. Such developments, he said, could force a reassessment of policy settings in Europe.

A more acute risk, Lane suggested, would be any departure by the Federal Reserve from its policy mandate. U.S. President Donald Trump has repeatedly pushed for faster and deeper rate cuts, a stance that Lane said could prove economically destabilising if it undermined the Fed’s credibility or allowed inflation to remain elevated.

Lane also flagged the potential for broader financial shocks, including a reassessment of the dollar’s global role. Such a shift could weigh on the euro, particularly after last year’s sharp appreciation, which hurt export competitiveness at a time when European firms were already facing pressure from low-cost Chinese goods.

Despite those risks, Lane said he remained confident in the Fed’s commitment to its mandate and reiterated that euro zone inflation is expected to stabilise sustainably at 2%, in line with ECB projections published in December. Under those conditions, he said, there is “no near-term interest rate debate,” with the current policy stance expected to hold for several years.

Market pricing briefly flirted with the idea of an ECB rate hike in late 2026, but expectations have since shifted toward rates remaining steady at around 2% throughout 2026. Lane added that while cyclical growth is likely to strengthen this year and next, longer-term potential growth remains weak, underscoring the need for deeper structural reforms across the euro area.