A bit of a different take on the ECB rate cut. In a recent note, PIMCO highlighted that while the European macroeconomic outlook is softer than anticipated, risk management continues to drive central bank decisions.

- The analysts suggested that any unexpected inflationary pressures could lead the European Central Bank (ECB) to slow the pace of future rate cuts, although last Thursday's reduction provides a safeguard against downside risks.

- Despite persistent inflation, largely fueled by price pressures in the services sector, PIMCO expects the ECB to maintain a tight monetary policy stance for the time being.

- The firm emphasized that upcoming economic data will be crucial in determining how quickly the ECB eases its restrictive policies.

- PIMCO also anticipates that the ECB’s Governing Council will engage in discussions about the appropriate neutral policy rate next year, particularly once the rate falls below 3%.

- The firm believes that another rate cut is likely in December, and views market pricing for a terminal rate of around 1.85% in the second half of 2024 as reasonable.

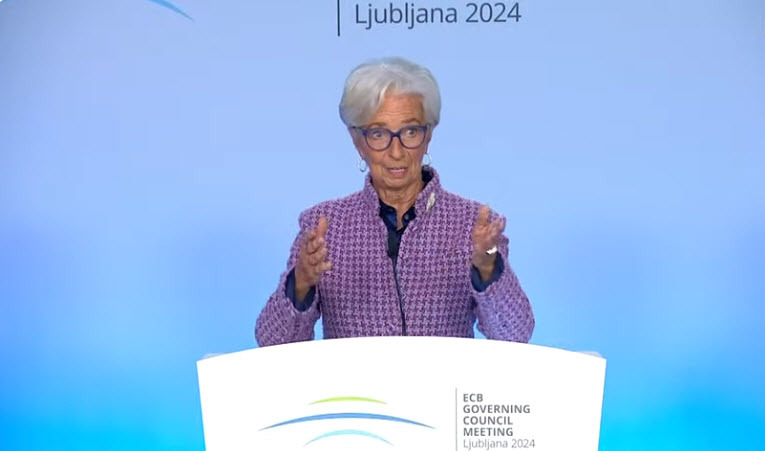

European Central Bank President Lagarde