Lagarde opening comments:

- The services sector continue to grow especially from a pickup in Digital services

- Manufacturers held back by tariffs.

- Divergence between domestic and external demand to persist.

- Labor market has cooled

- Economy should benefit from consumption.

- Household continue to save at an unusually large

- Global environment remain a drag

- Manufacturing orders .2 for the declining above.

- Indicators of underlying inflation consistent with target, with labor costs moderating further.

- Forward-looking wage indicators .2 slower wage growth

- Longer term inflation expectations around 2%.

- Some growth downside risks have mitigated (cites trade negotiations and peace in middle east).

- Trade environment remains volatile.

- Russia's aggression toward Ukraine remains a major uncertainty.

- Outlook for inflation more uncertain than usual.

- Stronger euro could bring down inflation further than expected.

- Defense spending boosted could increase inflation and medium-term.

- Not pre-committing to a rate path.

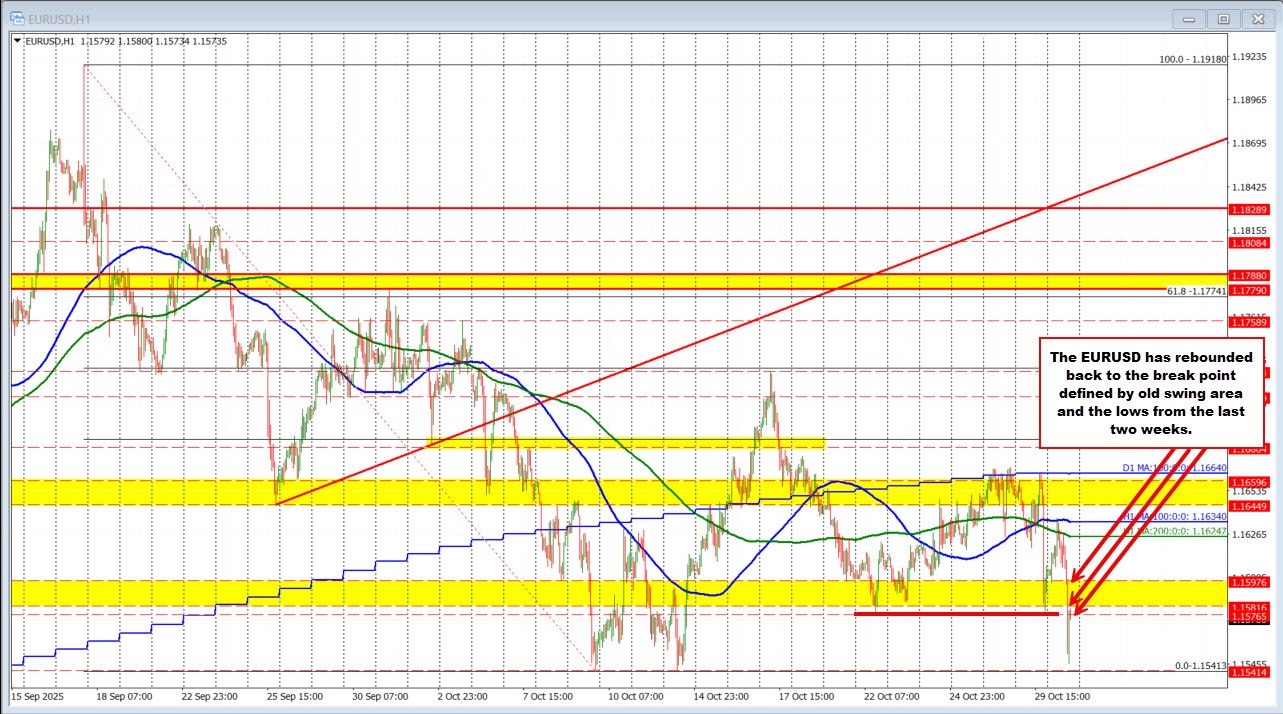

The EURUSD rebounds back to the swing area and lows from the last two weeks. At the lows, the EURUSD stalled just ahead of the double bottom target from the lows from October.

Q&A begins 10:03 AM ET:

- We are in a good place. We will do whatever is needed to stay in a good place.

- I would not complain about growth. We could do better.

- Corporate are moving ahead with AI investments.

- Labor impact of AI will take time.. There will be job creation, and job destruction.

- One risk not yet materialized is from bottlenecks and supply chain disruptions

- There was unanimity on the October decision

Summary of comments:

Lagarde Opening Remarks

Lagarde said the services sector continues to expand, driven notably by growth in digital services, while manufacturing remains constrained by tariffs. She noted an ongoing divergence between domestic strength and weak external demand, with household consumption expected to support growth despite unusually high savings rates.

The global environment remains a drag, though some downside risks have eased due to progress in trade negotiations and relative peace in the Middle East. However, Russia’s war in Ukraine continues to pose major uncertainty. She said manufacturing orders are stabilizing, and indicators of underlying inflation are consistent with the ECB’s target, supported by moderating labor costs and slower wage growth ahead. Long-term inflation expectations remain around 2%, but Lagarde cautioned that inflation risks are more uncertain than usual—a stronger euro could lower inflation faster, while higher defense spending could push it up in the medium term.

Lagarde reiterated that the ECB is not pre-committing to a particular rate path and will remain data-dependent in its policy approach.

Q&A Highlights

Lagarde said, “We are in a good place,” adding that the ECB will do whatever is necessary to maintain stability. She expressed cautious optimism, saying growth could be stronger but is holding up reasonably well. She highlighted corporate investment in AI as a positive development and noted that its labor market impact will take time, creating both new jobs and displacing others. She also mentioned that supply chain bottleneck risks have not yet reemerged and confirmed there was unanimous support for the October policy decision.