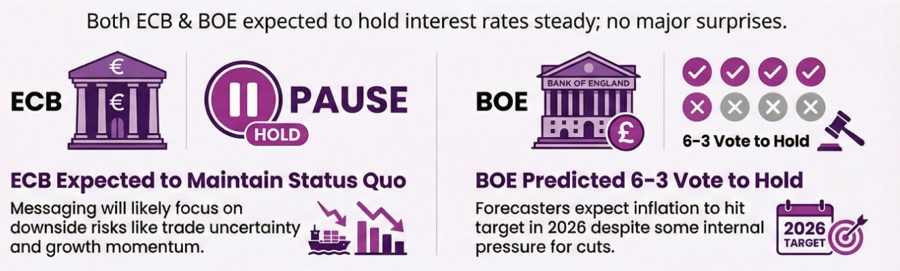

The central bank bonanza will return tomorrow with both the ECB and BOE delivering on their respective monetary policy decisions. No major fireworks are expected whatsoever, so it should be rather straightforward. And that is precisely what Morgan Stanley is arguing as we look to the decisions tomorrow.

On the ECB, the firm notes that:

"We expect the ECB to remain on hold, and keep its messaging unchanged. The decision will likely revolve around downside risks, focusing on increased trade uncertainty, growth momentum, and the exchange rate."

As for the BOE decision, Morgan Stanley is siding with a 6-3 vote on the bank rate in favour of keeping it unchanged. Their short-form note says that:

"We expect a 6-3 vote for a hold, with inflation projected at target in 2026, and with slack upped on a higher jobless rate. We expect unchanged guidance."

The more detailed version outlines that they are expecting Ramsden, Dhingra, and Taylor to dissent for a 25 bps rate cut. On the bank rate vote itself, they see "risks a bit more skewed towards a 5-4 vote split than a 7-2 one". Adding that:

"We can tally up five plausible votes for a cut – Taylor, Dhingra, Breeden, Ramsden and Mann – although we think that neither Breeden nor Ramsden would vote for a cut against Bailey, should there be enough external members' votes to deliver one."

As for policy moves by the central bank, they note that:

"We think that the terminal rate could fall to 3%, with cuts in March, July and November. A faster global growth uptick than projected by Morgan Stanley, as well as a sharp change in fiscal policy direction in the UK, remain key risks to that view."

Just keep in mind that in December, they had February pegged for a rate cut and have now pushed that to March.