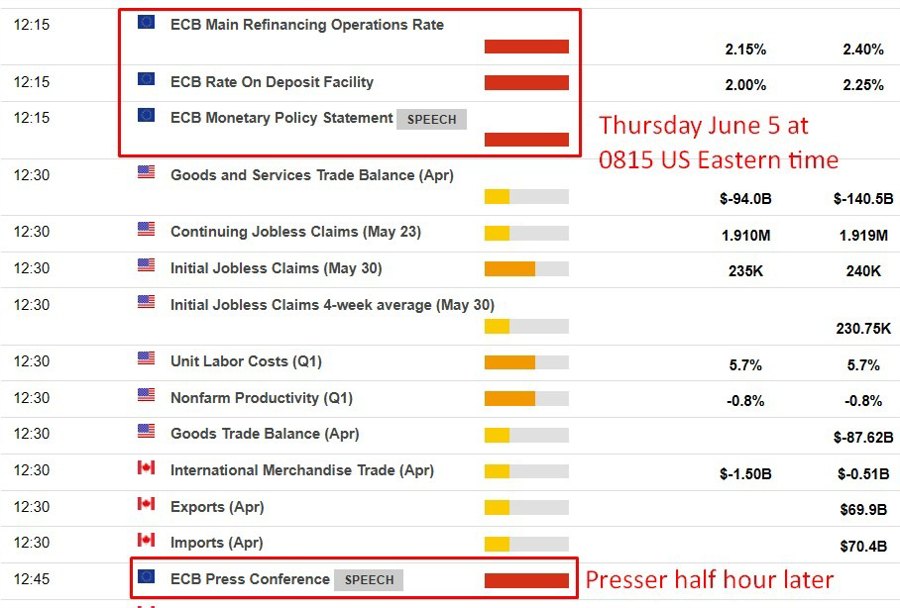

Deutsche Bank expects the European Central Bank to lower its key interest rate by 25 basis points to 2.00% at its June 5 meeting, marking a cumulative 200bp of cuts from the peak and bringing rates closer to a neutral stance. The bank anticipates the ECB will maintain its meeting-by-meeting, data-driven approach to policy decisions.

However, analysts at DB warn that convincing more hawkish Governing Council members to support the move may require signaling a degree of patience on further cuts. Deutsche is holding to its terminal rate forecast of 1.50% but acknowledges that growing macroeconomic resilience and a looming ramp-up in defence spending may limit the ECB’s scope to ease further.

The analysts say that if the trade war dampens growth in the second half and disinflation trends hold, a September cut to 1.75% would be justified. But whether the ECB will go as far as 1.50% before year-end is increasingly uncertain. Recent developments have raised the risk that the easing cycle could stop short of that level, with Deutsche concluding that the policy outlook remains highly fluid.