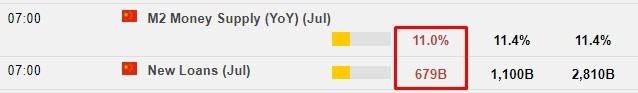

Data from China on Friday on financing. New loans slumped, even as money supply (M2 +11%) grew strongly - i.e. plenty of cash sloshing about but its not in demand:

The chief China economist at Pantheon Macroeconomics says such a combination of data is a “classic sign of a liquidity trap” .

- “Liquidity is ample, but no one wants it.”

The remarks come via a Bloomberg piece (gated, but an ungated one can be found here):

- The mismatch between liquidity and bank lending is also raising financial risks as market interest rates drop well below policy rates set by the central bank.

- “Liquidity is piling up in the interbank market and there’s even a risk of money being directed out of the real economy and into markets,” said Ming Ming, chief economist at Citic Securities Co.

--

Risk of money being directed into markets could very well translate to a bullish input for Chinese stocks.

ps. Coming up on Monday is a maturing MLF. A majority of analysts expect the PBOC to not fully roll the amount maturing (that is, a net withdrawal of cash). On the 20th we get the monthly loan prime rate setting from the PBOC (preview here).