The Bank of Canada conducted a survey on business and household reaction to the tariffs. The findings showed:

- Economic Uncertainty: Businesses and households find the economic climate unpredictable due to shifting U.S. tariffs and their uncertain implementation timeline.

- Investment and Hiring Challenges: Businesses struggle to make investment, hiring, and pricing decisions amid ongoing trade uncertainty.

- Survey Findings: Data from late January and February highlight concerns over a 25% U.S. tariff and potential Canadian retaliation. The Bank of Canada will continue monitoring business and household sentiment.

- Household Spending: Trade tensions have raised job security concerns, leading households to reduce spending, especially in trade-dependent sectors.

- Business Sales Outlook: Companies have downgraded sales expectations, with order books and inquiries declining, particularly in manufacturing and discretionary spending sectors. However, a “Buy Canadian” trend is helping mitigate some of the negative effects.

- Hiring and Investment Pullback: Businesses are cutting back on hiring and new investments due to trade uncertainty, driven by:

- Tighter credit conditions.

- Rising costs of imported capital goods (equipment/machinery).

- Ongoing Investment: Most businesses are proceeding with existing projects focused on maintaining capacity and improving productivity.

- Oil & Gas Sector: Short-term investment and production remain stable, but tariffs could deter medium-term investment.

On inflation:

Rising Costs Due to Trade Conflict: Businesses report higher costs driven by multiple factors:

- Weaker CAD since October 2024, making imports more expensive.

- Tariffs and trade restrictions affecting supply chains and input costs.

- Diversifying suppliers to avoid tariffs, often leading to higher costs.

- Uncertainty in trade policy, making price contract negotiations difficult.

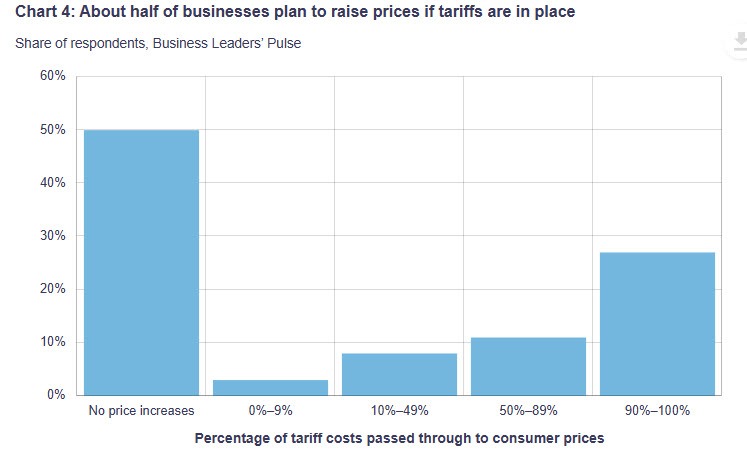

Planned Price Increases:

- Half of businesses plan to raise prices if tariffs are imposed.

- 75% of those businesses expect to pass on more than half of tariff-related costs to customers.

- Retailers may quickly adjust prices, but competition, weak demand, and tariff scope could limit increases.

Businesses Holding Prices Steady:

- Those not impacted by tariffs on inputs or products.

- Some facing cost increases but choosing not to pass them on.

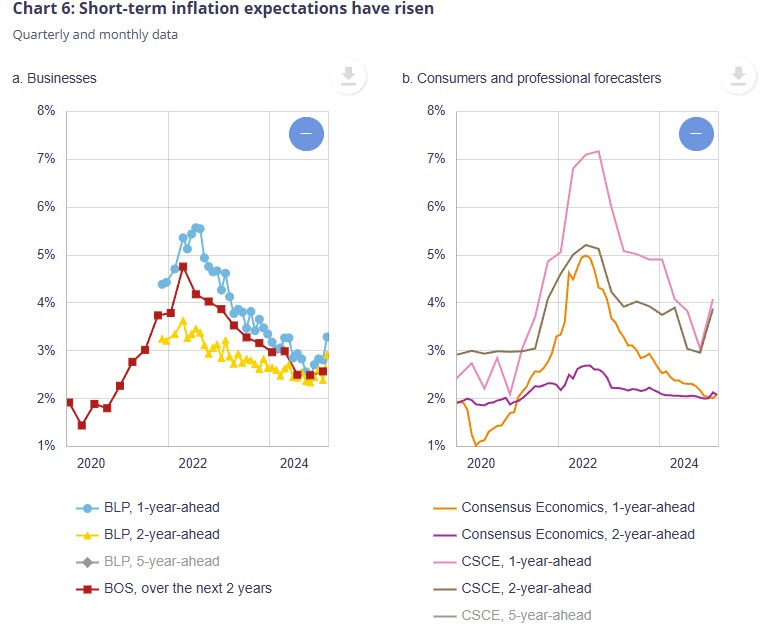

Inflation Expectations Rising:

- Both households and businesses anticipate higher prices due to trade tensions.

- Short-term inflation expectations have recently increased.