TL;DR summary:

BoJ says policy rate remains far below neutral despite recent hike

Several members favour steady further rate increases

Real interest rates seen staying deeply negative even at 0.75%

Yen weakness and bond yields partly blamed on overly low rates

Stronger wage-price dynamics reinforce tightening case

Full text:

The Bank of Japan’s December Summary of Opinions reinforced the message that Japan remains some distance from neutral monetary settings, even after last week’s landmark rate hike, while underscoring growing conviction among policymakers that further tightening will be required to avoid falling behind the curve.

According to the Summary released by the Bank of Japan, one policy board member said there is still “quite some distance” before the policy rate reaches a neutral level, despite expectations that the real interest rate will remain deeply negative even after the policy rate is lifted to 0.75%. Several members argued that maintaining excessively accommodative conditions could distort resource allocation and weigh on sustainable growth over time.

The discussion showed broad agreement that Japan’s economy has recovered moderately, with business sentiment holding up and wage growth expected to remain firm into next year. Policymakers highlighted that corporate profits have been sufficiently strong to support continued wage increases, reinforcing confidence that the mechanism of rising wages and prices is becoming entrenched. Underlying inflation, while likely to soften temporarily due to base effects, was still seen as moving steadily toward the 2% target.

On policy execution, views diverged slightly on pace but not direction. One member said the Bank should raise rates at intervals of “around once every few months” for the time being, while others cautioned against committing to a fixed schedule. Instead, they stressed the need to scrutinise economic, price and financial developments at each meeting, particularly given uncertainty over overseas interest-rate cycles.

A recurring theme was concern that Japan’s real policy rate remains the lowest in the world. Several members argued this was contributing to yen weakness and upward pressure on long-term yields, suggesting that timely rate adjustments could help curb future inflationary pressure and stabilise bond markets. At the same time, policymakers acknowledged the importance of carefully monitoring the impact of higher nominal rates on the economy and financial conditions.

The Summary also highlighted a rare degree of alignment between fiscal and monetary policy. One member said Japan is in a phase where both can complement each other, echoing comments from government representatives who stressed close coordination to achieve sustainable growth and price stability.

Overall, the Summary signals a Bank increasingly confident in Japan’s inflation outlook, more alert to the risks of policy inertia, and preparing markets for continued, albeit cautious, policy normalisation rather than a one-off adjustment.

---

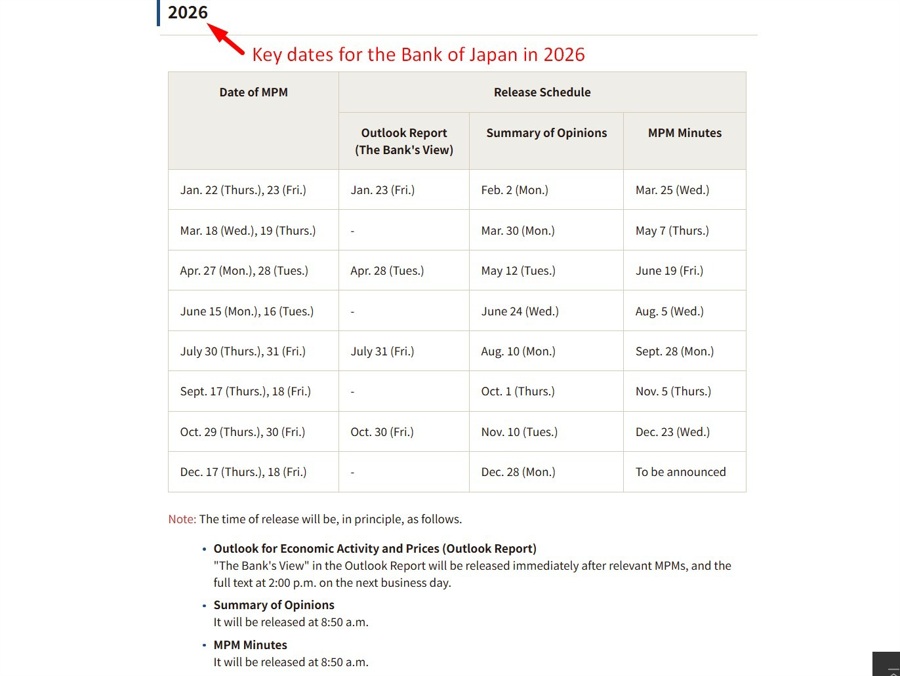

BOJ dates for the new year ahead:

---

I've posted before on what this Summary is:

- The summary includes the views of the Policy Board members on economic conditions, both domestically and globally. This includes assessments of economic growth, inflation, and employment trends, among other indicators.

- The summary also outlines the Policy Board members' views on the effectiveness of the BOJ's current monetary policy measures, including interest rate policy, asset purchases, and yield curve control. Members may discuss the pros and cons of these policies and their potential impact on the economy.

- The summary includes discussions on the outlook for monetary policy and the potential risks to the economy. Board members may express their views on the appropriate timing and direction of future policy changes, as well as the potential impact of external factors such as global economic conditions.

- The summary also includes any dissenting views among the Policy Board members. If a member disagrees with the majority view on a particular issue, they may express their own opinion and rationale.

In a few week's time we'll get the Minutes of this meeting. The Minutes are a more detailed record of the discussions and decisions made during the meeting.

- The Minutes include a more complete record of the views expressed, including any dissents or alternative opinions that may not be included in the summary.

- The Summary of Opinions is typically released a few days after the policy meeting, while the Minutes are published about a month later. This means that the Summary of Opinions can provide more up-to-date information on the BOJ's current stance and view on the economy and monetary policy.

- The Summary of Opinions is usually written in a more accessible language, making it easier to understand the BOJ's views on monetary policy.

- The Minutes, on the other hand, are often more technical and may require a deeper understanding of economics and financial markets.

- The Summary of Opinions is typically shorter than the Minutes.