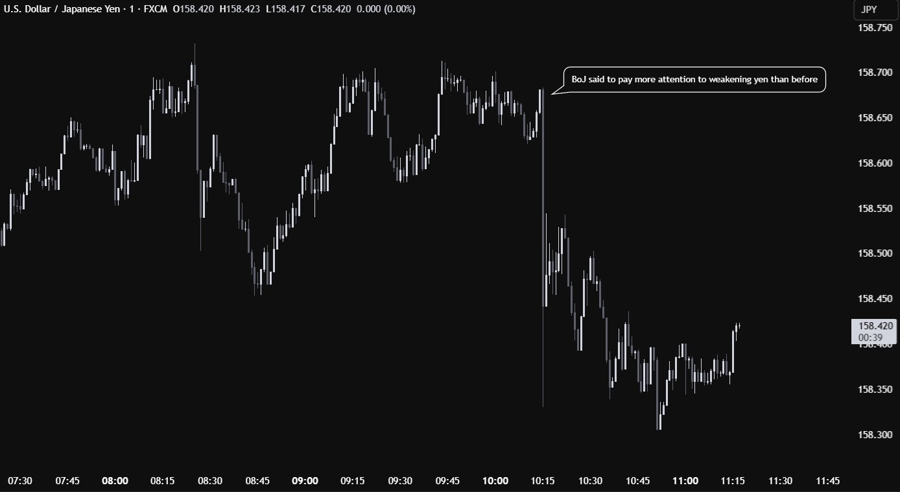

Bloomberg reports that the BoJ officials are paying more attention than before on the weakening yen and its potential impact on inflation. According to people familiar with the matter, this might have implication for future rate hikes even though the central bank is likely to hold rates steady next week.

The odds of a rate hike in March jumped to 22% following the news. This would be much sooner than expected and could give the Japanese Yen a boost in the short-term if speculations of an earlier hike keep increasing.

Yesterday, the JPY strengthened across the board following a barrage of verbal intervention from Japanese officials as the price approached the key 160.00 handle which triggered the previous interventions in 2024.

On the 1 hour chart, we can see that USDJPY fell yesterday following the intensification of verbal intervention. We have now a consolidation defined by the minor counter-trendline. The buyers will likely continue to lean on it to keep pushing into new highs, while the sellers will look for a break lower to increase the bearish bets into the next major trendline around the 157.50 level.