This is arguably the final piece of the puzzle in concluding the pivot towards monetary policy normalisation for the BOJ. However, it is one that is going to take almost forever to complete. In fact, none of us will be around to even witness the completion. And that is if things go according to plan - in which we know in markets that they don't often do.

The guideline for selling of its ETF and REIT holdings will take effect on 19 January. And that means they could begin sales in the coming days or perhaps very soon after.

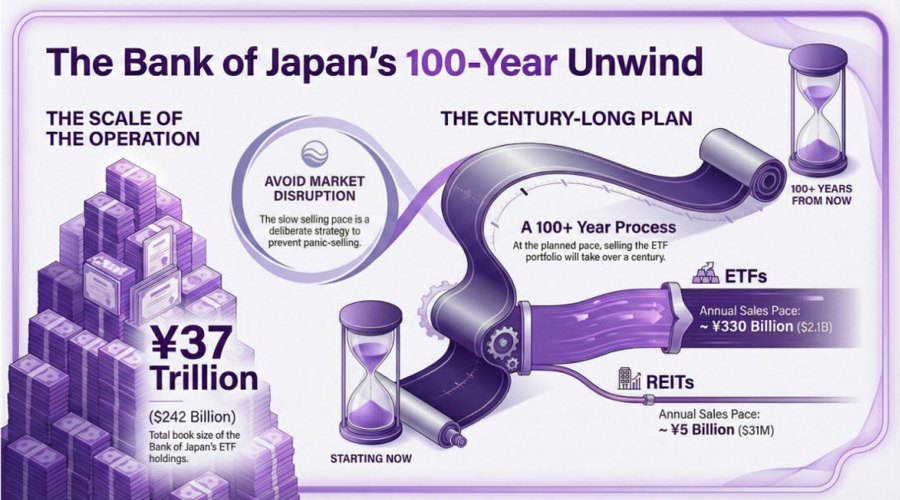

That being said, their ETF holdings have an extremely large book size of ¥37 trillion ($242 billion). So in order to avoid any major disruption to the market and cause panic-selling in Japanese stocks, the central bank is planning to offload them in a slow manner. And when I mean slow, it is very, very, very slow.

The annual pace of selling in ETFs is going to be roughly ¥330 billion ($2.1 billion). And if you compare that to their book size, it means that this is an operation that would take over 100 years to be completed if said pace is to be maintained throughout. ¯\_(ツ)_/¯

As for REITs, they will be shedding that at an annual pace of ¥5 billion ($31 million). So, the amount there is nothing as nearly as impactful as the focus on ETFs.