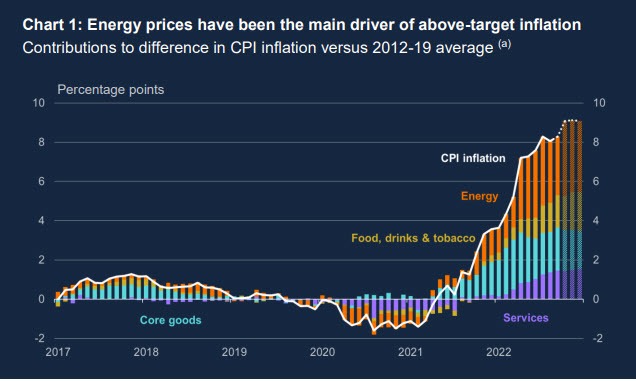

- Energy prices are pushing up prices in the short term but have medium term disinflationary impact

- BOE needs to balance energy impact against any 2nd round effects

- I would expect that bank trade counter at 3% over 2023 reduce output further below potential

- policy will likely have to loosen in 2024 to try to prevent inflation falling below target

- policy should focus on inflation , not offsetting losing guilt yields or FX rates

- most of the impact on demand of tighter bank trade yet appear

- my main rationale for further tightening of monetary policy last week was risk management

- BOE needs to guard against over tightening policy

- it is too early to judge whether the labor market will loosen as forecast by the Bank of England

- UK demand likely to fall even if energy prices fall back

- initial signs and UK labor market is starting to loosen

- UK likely to be in recession in Q4, mostly due to lower real incomes.

You can find the full speech by CLICKING HERE