Rogers was asked about the Canadian dollar and said that if it depreciates, imports will become more expensive and that will put upward pressure on prices. She said that if that happens, it will need to be built into BOC forecasts.

She was careful not to comment on the value of the currency and I don't think there's a takeaway here. I've written many times about the risks of imported inflation in H2 if the BOC shifts to a dovish stance on a severe slowdown in housing and consumption.

The question is: Would that stop them from cutting? I don't think it would but it might limit how far they go.

Emerging markets have been dealing with dynamic forever, including in the past year as the dollar surged and global inflation rose.

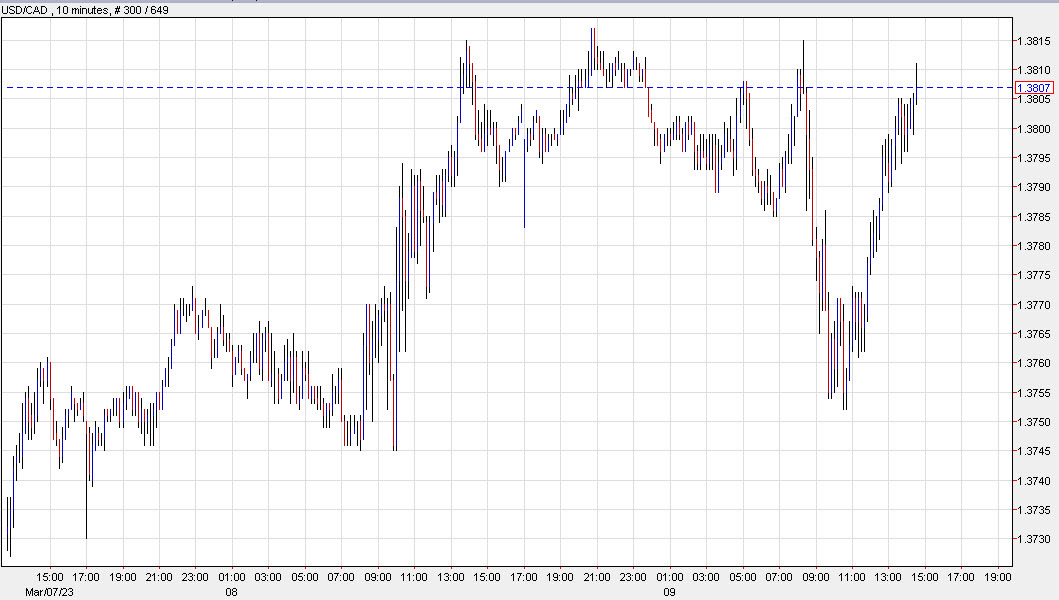

In terms of today, USD/CAD has gone on the same ride as other risk trades: