- If an accumulation of evidence or a shock comes, we're prepared to change our stance

- if something crystallizes, we will assess

- Canadian firms' adjustments to US tariffs will last at least through end-2027

- I hope the Fed retains its independence

- The USD safe haven status has been dented

- Recent USD weakness is largely driven by geopolitical events

- Governing council felt it was hard hard to assign probability to the risks to the outlook

- The era of open, rules-based trade with the US is over

- Companies are increasingly seeing that the days of open trade with the US are over

"Most countries import or export with the US, we build things together," he said. Macklem highlighted how intermediate goods move across the border and that some goods were simply shipped through the US. That makes it tough to understand what's happening in trade.

There weren't any real market moving comments in the press conference and the main message is that they don't know what's next but they feel rates at 2.25% give them flexibility to move in either direction. Inflation is also within the target band.

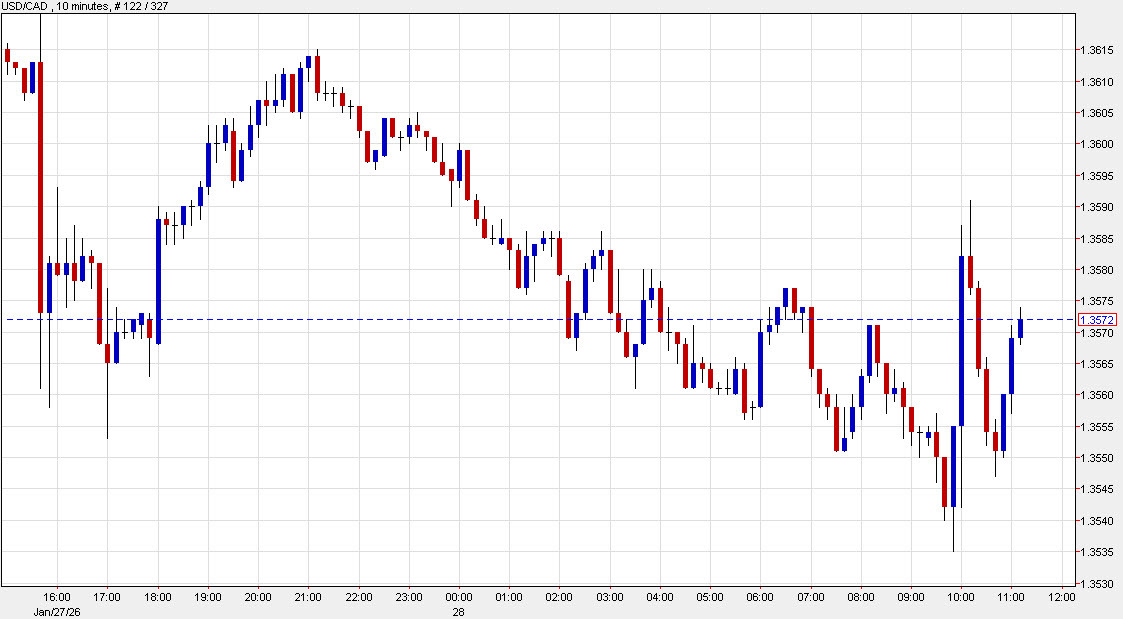

USD/CAD was choppy through the decision but the largest move was a dollar climb on Scott Bessent's comments.

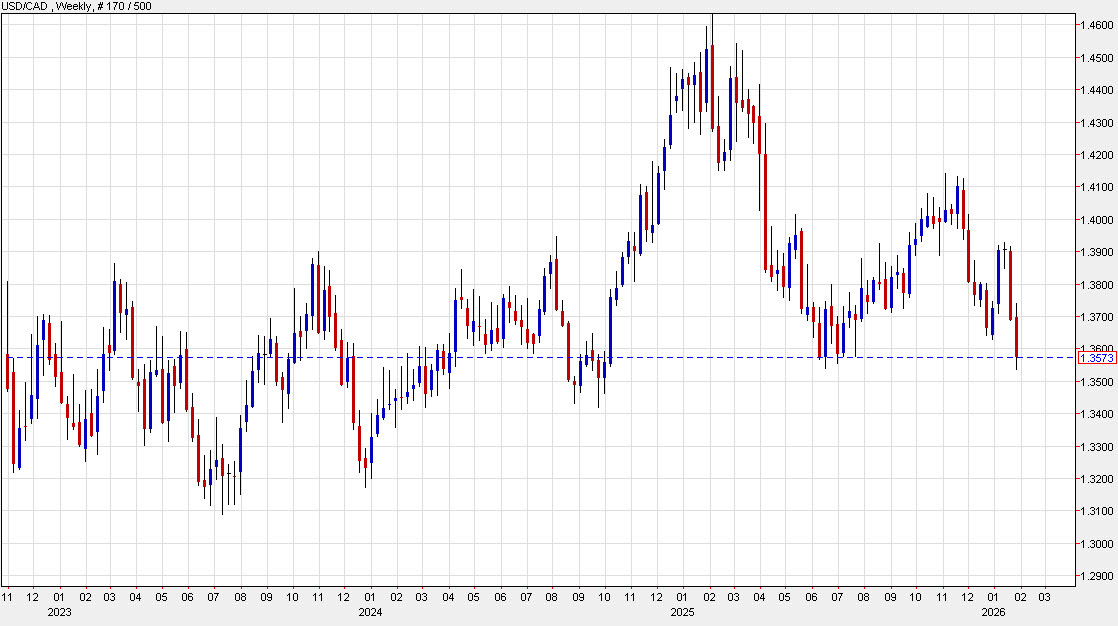

At the lows today, USD/CAD fell to its lowest since October 2024 as the pair narrowly touched below the July lows.

The weekly chart is looking like a huge head-and-shoulders top.

Aside from the uncertainty with trade, there is plenty to like in Canada. It's a country flush with natural resources at a time when they're increasingly in favor. The Carney government is working to make it easier to build as well, at least in theory.

Bessent today also said that he thought it would work out via USMCA, which is an indication that the agreement is likely to continue despite all the rhetoric.

A lot can go right with the loonie this year, something I talked about at the start of the year.