The Bank of Canada's Macklem is on the wire saying:

- The time of rate announcements by the Bank of Canada will change to 9:45 AM ET from 10 AM, effective Jan 24, 2024; a press conference will follow every rate announcement.

- Rate announcements by the Bank of Canada will be released 15 minutes earlier starting in 2024.

- The deadline for the Bank of Canada's securities repo operation will be moved to 10:15 ET from 10 AM, effective Dec 18; the timing for the release of call for tenders will also change.

- The 2% inflation target is now in sight, though not yet achieved; conditions increasingly seem in place to reach this target.

- Further declines in inflation are likely to be gradual due to varying influences in the coming months.

- The next two or three quarters are expected to be difficult for many, with a likely increase in the jobless rate.

- It's still too early to consider cutting the policy rate; inflation has decreased but remains too high.

- As economic growth slows, inflation pressures are expected to ease, though unexpected challenges may arise.

- The consideration of rate cuts will occur once a clear path back to price stability is assured.

- Economic growth is expected to remain weak into 2024, following a stall through mid-2023.

- Shelter price inflation is expected to moderate over time, but the exact timing is uncertain.

- 2024 is anticipated to be a year of transition, leading to a more balanced economy after a period of weakness.

- Growth and job creation are expected to pick up later in 2024, with inflation approaching the 2% target.

- The next few years are anticipated to be less volatile than the recent past.

- The appropriateness and duration of restrictive monetary policy will continue to be a subject of discussion.

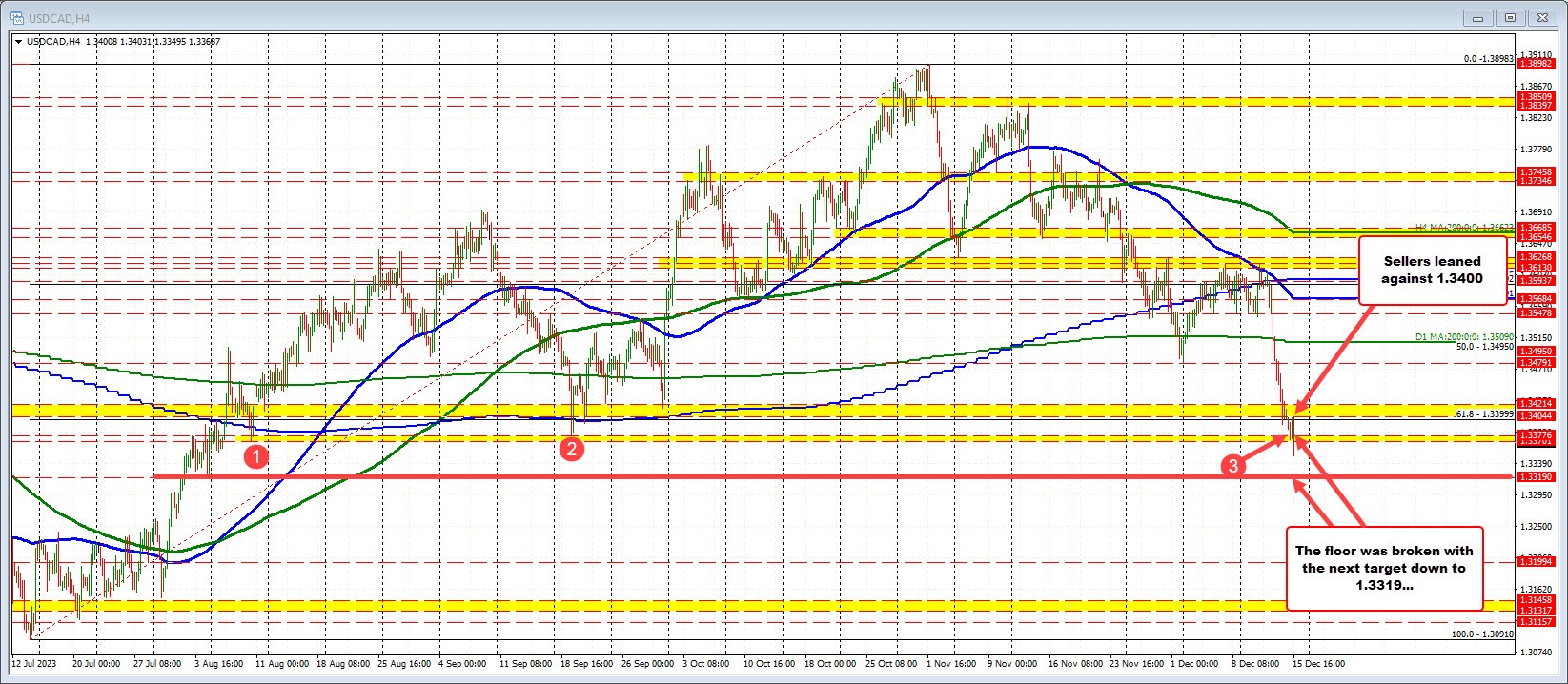

The USDCAD did break below the earlier floor at 1.3370 to 1.33776 (see earlier video). There is not a lot of support until 1.3319. Stay below 1.3377 keeps the sellers in firm control.