From BlackRock's "Weekly market commentary" ahead of the CPI data due today from the US.

Some of the commentary and market implications of sticky inflation:

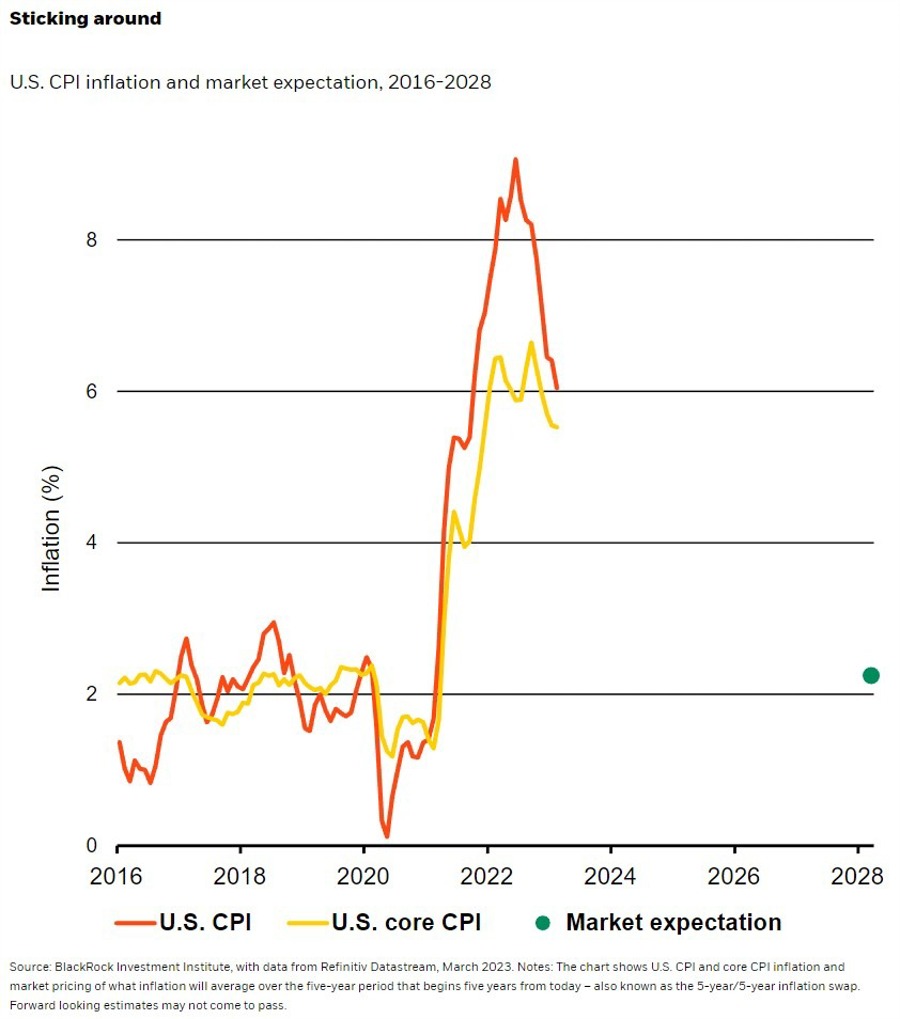

- U.S. inflation data this week will show core inflation remaining well above the Fed’s 2% target. We don’t see the Fed hiking enough to get it all the way to 2%.

- The Fed is sticking to hiking rates to get inflation down to target, even as financial cracks start to appear. We think the Fed will eventually stop hiking when the damage becomes more apparent. That means it won’t have done enough to create the deep recession needed to achieve its inflation goal, so it will be living with some above-target inflation. Updated Fed forecasts last month noted as much, with PCE inflation floating around 3% at year-end – even as the Fed expects growth to stall.

- We remain tactically underweight developed market shares and expect corporate earnings to come under pressure – and the upcoming earnings season starting this week may reveal such damage. We prefer emerging market peers that better price in the economic damage we expect.