Summary:

Bank of Korea (BoK) seen holding base rate at 2.50% on January 15

Won weakness and inflation risks limit easing scope

Central bank signals end of easing cycle

Seoul housing prices complicate policy outlook

Next rate cut pushed back to 2027

South Korea’s central bank is expected to extend its policy pause this week, with economists unanimous that the Bank of Korea will hold its base rate at 2.50% at Thursday’s meeting as currency weakness, inflation risks and housing-market pressures limit scope for further easing.

All 34 economists surveyed in a Reuters poll forecast no change in rates on January 15, reflecting concern that the recent fall in the Korean won could feed through to higher import prices and complicate the inflation outlook. The won has weakened nearly 2% so far this year, an issue the BOK itself flagged at its November meeting as a constraint on policy flexibility.

South Korea’s inflation rate eased to 2.1% in 2025, down from 2.3% the year before, but remains above the BOK’s 2% target. With price pressures still elevated and the currency under strain, policymakers appear reluctant to resume rate cuts despite signs of moderating growth.

The central bank has also signalled it may be nearing the end of its easing cycle, subtly shifting its forward guidance. Language referring to a continued rate-cut stance has been replaced with wording that the board will decide “whether and when” to implement any further cuts, reinforcing expectations of a prolonged pause.

Housing dynamics add another layer of complexity. Apartment prices in Seoul rose 0.18% in the week to January 5 and climbed 8.7% over 2025, underscoring concerns about financial stability risks should borrowing costs fall further. Economists said elevated house-price expectations have sharpened the BOK’s focus on maintaining currency stability and containing asset-price pressures.

Reflecting this reassessment, the Reuters poll showed expectations for the next rate cut have been pushed back to 2027, a notable shift from November, when more than 60% of respondents anticipated at least one cut in early 2026. Only 22% now expect a cut this quarter.

Looking ahead, South Korea’s economy is forecast to grow 2.0% in 2026, slightly above the BOK’s own estimate, while inflation is seen averaging 1.9%, just below the central bank’s projection — a mix that supports patience rather than urgency.

---

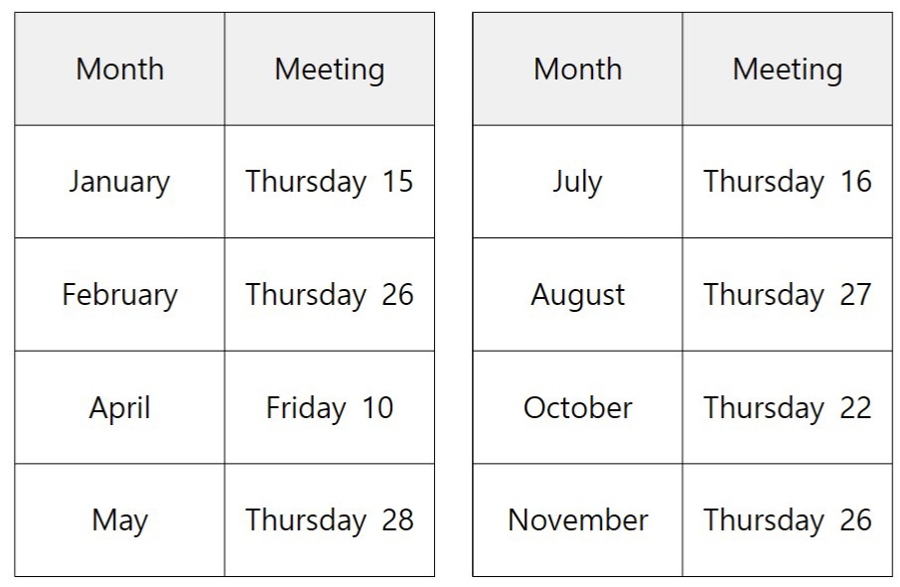

Bank of Korea dates this year: