The BoE is set to hold rates steady, with messaging and the vote split key to near-term market reaction.

Summary:

Bank of England expected to keep Bank Rate unchanged at 3.75%

Inflation set to fall sharply, but wage growth remains a concern

Guidance likely to stay vague and data-dependent

Vote split and tone seen as more important than the decision

Markets have pared back expectations for rate cuts this year

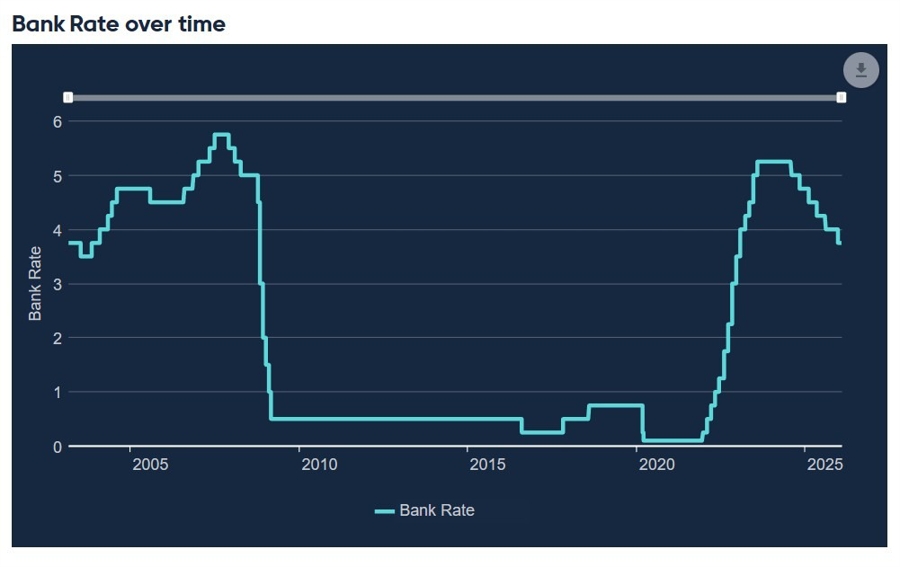

The Bank of England is widely expected to leave policy unchanged when it announces its February decision on Thursday February 5, with Bank Rate likely to remain at 3.75%. With a rate cut delivered just before Christmas and inflation dynamics still uneven, policymakers appear in no rush to accelerate easing.

While headline inflation is expected to fall sharply in coming months and move closer to the 2% target, underlying pressures continue to complicate the outlook. Services inflation and wage growth remain elevated, leaving parts of the Monetary Policy Committee uneasy about declaring victory. As a result, guidance is expected to remain deliberately non-specific, reinforcing a data-dependent approach rather than offering firm signals on the timing or scale of future cuts.

The vote split will be closely watched. A narrow or divided outcome would suggest the committee is edging closer to further easing, even if policy is left unchanged. Conversely, a more unified vote to hold rates steady would point to continued discomfort around domestic inflation pressures, particularly in the labour market, and a willingness to keep policy restrictive for longer.

Market pricing reflects this uncertainty. Expectations for rate cuts this year have been scaled back materially, with investors now attaching a low probability to near-term easing. This repricing reflects not only domestic inflation concerns but also changing global dynamics, including firmer economic momentum in the UK and a reassessment of the likely pace of policy easing in the United States.

Updated economic projections are unlikely to show major changes from the Bank’s previous forecasts, which already pointed to inflation hovering around target over the medium term. Policymakers are also expected to remain alert to external risks, including geopolitical uncertainty and shifts in global financial conditions, even if recent market reactions have been muted.

For markets, the focus will be on messaging rather than mechanics. Any subtle shift in language around wages, labour-market slack or financial conditions could shape expectations for when the next move might come, even as the Bank keeps its options firmly open.