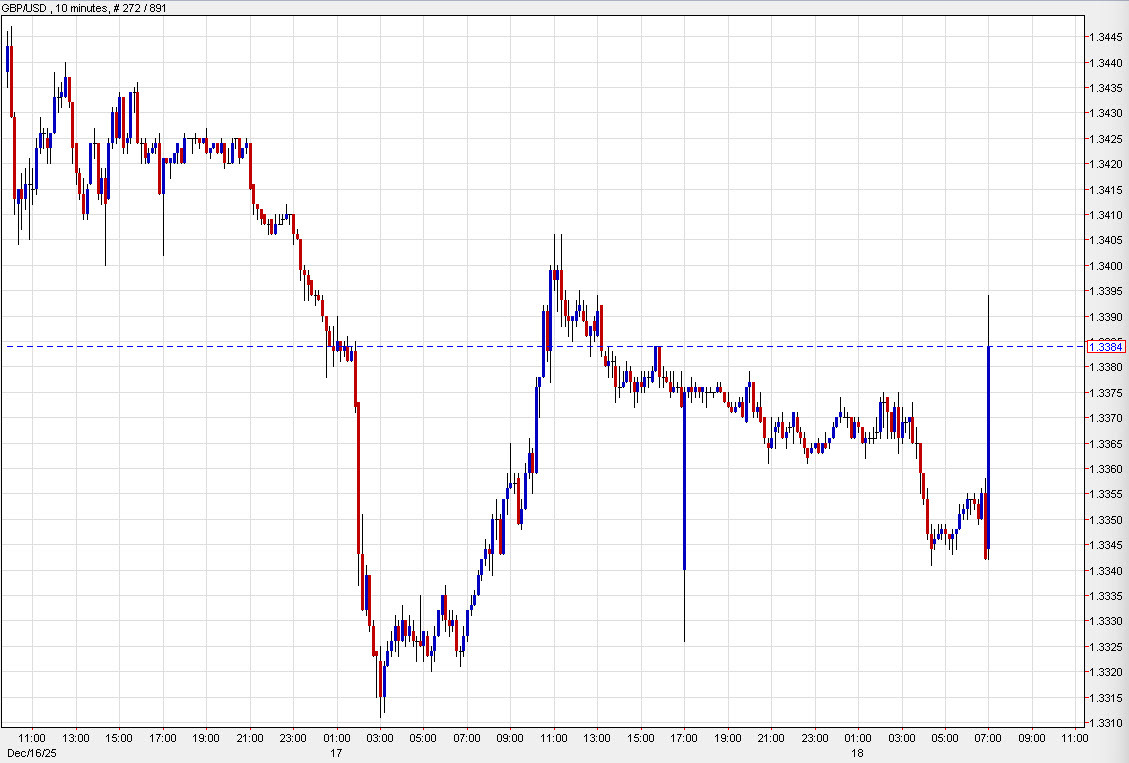

The Bank of England has delivered the widely anticipated 25bp cut, but the pound is catching a bid as the MPC signals that the "easy" part of the easing cycle is over. GBP/USD has jumped 35 pips on the release as the market digests a decision that was a genuine nail-biter and a statement that suggests the bar for 2026 cuts is higher.

A cut takes the Bank Rate from 4.00% down to 3.75%, after the "wait and see" pause in November.

The consensus estimate was for a vote of 5-4 in favor of a rate cut, with Bailey switching to the rate-cut camp. The cut was 100% priced in and that's exactly what unfolded.

Yesterday’s CPI print was a major catalyst. Headline inflation fell sharply to 3.2% (down from 3.6%), coming in lower than both market forecasts and the Bank's own projections. While services inflation remains "sticky" at 4.4%, the overall trend is moving in the right direction.

October GDP figures also showed a surprise contraction of -0.1%. The "V-shaped" recovery everyone hoped for after the Autumn Budget has yet to materialize, leaving the economy looking a bit anemic and unemployment has crept up to 5%.

Cable was trading at 1.3556 just ahead of the decision and quickly jumped to 1.3385 afterwards.

The Bank explicitly noted that as rates approach this neutral level (estimated between 2-4%), further easing becomes a "closer call".

Bailey warned that there is "more limited space" for further cuts and that the path forward cannot be pre-judged with precision.

The BoE is also warning of a temporary spike in inflation this month, driven by higher tobacco duties and airfares. While they acknowledge the "encouraging" drop to 3.2% in November, they expect the headline rate to stay above the 2% target until Q2 2026.

Highlights:

Vote split: 5-4. Bailey, Lombardelli, Taylor, Dhingra, and Breeden vote for a cut; Greene, Mann, Pill, and Duggan vote to hold.

Judgements around further policy easing will become a closer call" as rates approach neutral.

Staff forecast 0.0% GDP growth for Q4 (down from +0.3% forecast in Nov).

2025 Autumn Budget likely to cut inflation in April 2026 by ~0.5pp but add 0.1-0.2pp in 2027/28.

Data does not suggest a "rapid opening of slack,"