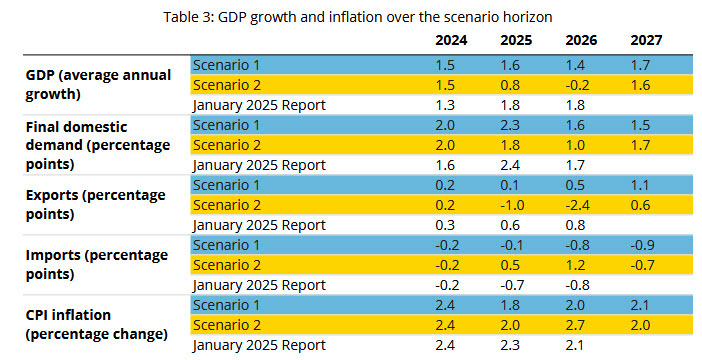

Rather than providing a traditional base-case projection, the Bank of Canada has presented two illustrative scenarios to account for the uncertainty around US trade policy.

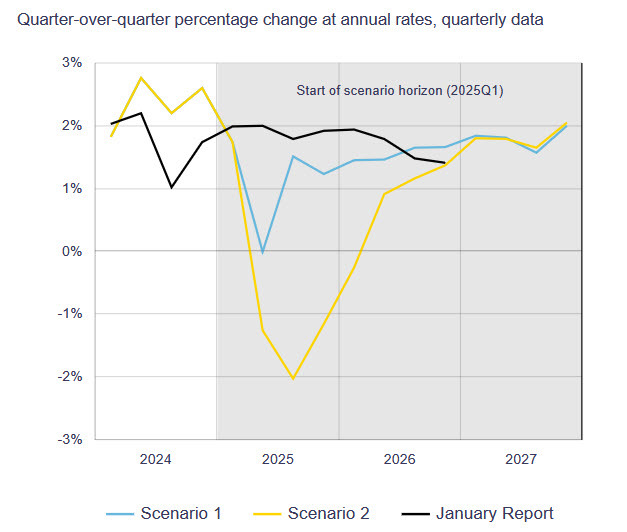

The Bank of Canada had previously signaled it would revise down its 2025 GDP forecasts, and indeed, in Scenario 1 (where most tariffs are eventually negotiated away), growth is projected at 1.6% for 2025, down from previous estimates at 1.8%. In the more severe Scenario 2 ("A long-lasting global trade war"), 2025 GDP growth could fall to just 0.8%.

Scenario 1:

- 2024: 1.5%

- 2025: 1.6%

- 2026: 1.4%

- 2027: 1.7%

Scenario 2:

- 2024: 1.5%

- 2025: 0.8%

- 2026: -0.2%

- 2027: 1.6%

The numbers here mask some of the weakness as they would see a four-quarter recession with an average 1.2% decline in annualized GDP in the back half of 2025 and first half of 2026.

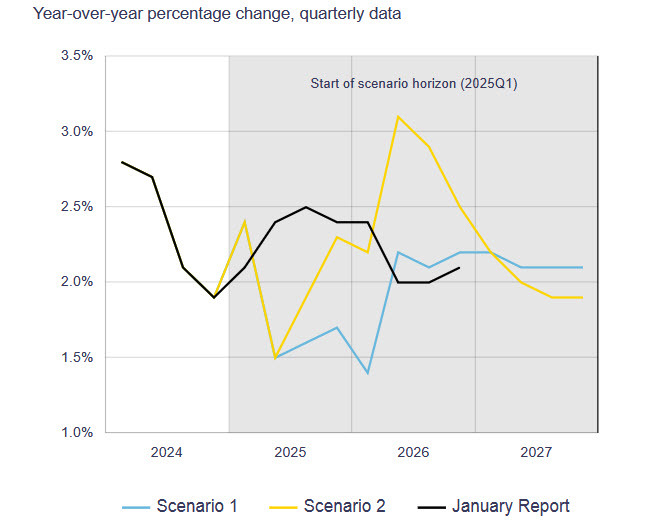

CPI inflation:

Scenario 1:

- 2024: 2.4%

- 2025: 1.8%

- 2026: 2.0%

- 2027: 2.1%

Scenario 2:

- 2024: 2.4%

- 2025: 2.0%

- 2026: 2.7%

- 2027: 2.0%

The negative scenario assumes this:

The United States imposes the following additional permanent tariffs:

- a 25% tariff on the non-US content of imported motor vehicles and parts

- a 12% tariff on imported goods, other than motor vehicles and parts, from Canada and Mexico

- a 25% tariff on all goods imported from all other countries

- a 15% tariff on all goods imported from China to lift the total new tariff on China to 25%

That's a fairly harsh scenario (though China looks optimistic). If anything, the recessionary forecast isn't that bad given the angst around tariffs.