Bank of Canada Deputy Governor Rhys Mendes is trying to straighten out core inflation measurement.

IN 2016, the BOC introduced measure of 'trim', 'median' and 'common' but that could be causing confusion in markets, according to Mendes.

- CPI-trim, which removes the top 20% and the bottom 20% of price changes each month

- CPI-median, which lines up all the monthly price changes from lowest to highest and picks the one in the middle

- CPI-common, which aims to track price changes that are common across categories

During the pandemic, the BOC stopped including 'common' in its 'preferred' measures due to pandemic changes but he also highlighted how the other two measures were 'less reliable' in the same period.

As for the current outlook, it's also skewed:

The starting point is, of course, total inflation. In August, total CPI inflation was 1.9%. At a glance, that seems pretty good—almost right at our 2% target. But our preferred measures of core inflation were giving us a very different signal—they were around 3%. One important reason for this difference was the removal of the consumer carbon tax.3 Inflation excluding taxes was 2.4% in August.

If we look more closely at core inflation, we see that all the measures we monitor rose at the start of 2025. In August, our preferred measures of core inflation were around 3%, but alternative core measures were around 2½%. So while our core measures were all telling us that underlying inflation had risen, they were giving us mixed signals on its actual level.

So what is real underlying inflation?

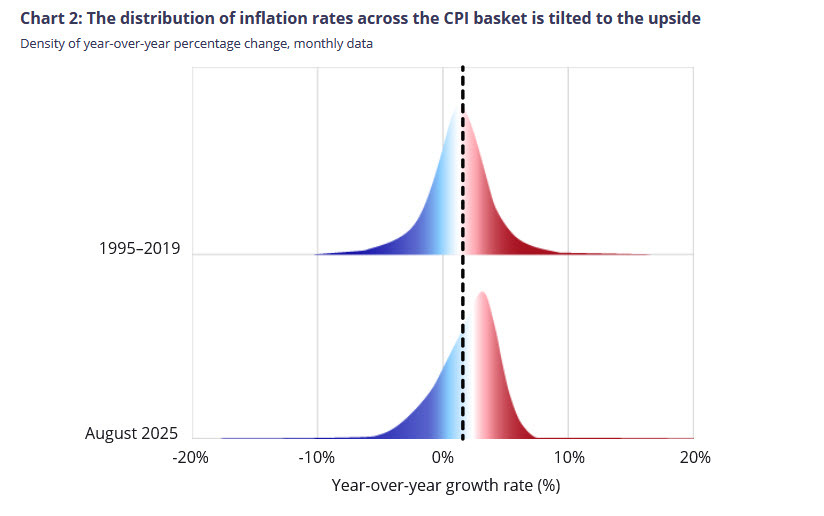

Mendes highlights a chart of inflation rates across the CPI basket. Notice how the current measure lands to the right of the longterm average.

Still, he says that core measures near 3% are overstating inflation.

On balance, the evidence pointed to underlying inflationary pressures above the 1.9% level of total inflation but below the 3% level suggested by the Bank’s preferred core measures. Most indicators pointed to underlying inflation in the vicinity of 2½%.

He notes that the half-point difference can mean the difference between holding and cutting rates.

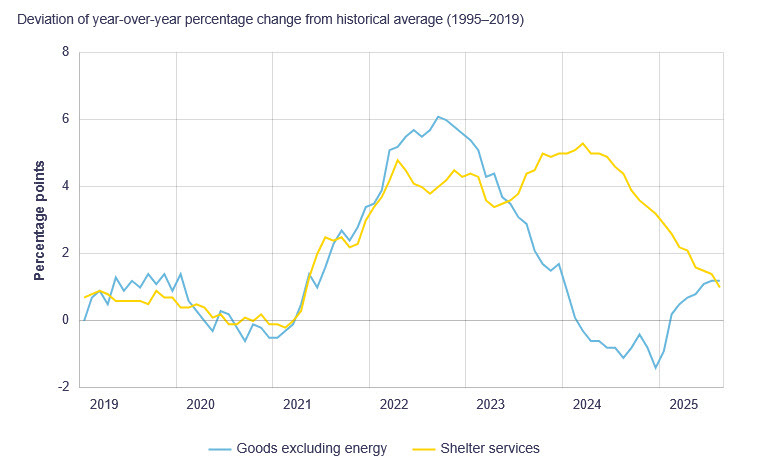

As for the trend, he highlights that goods prices are now above the pre-pandemic trend. Shelter is also adding upward pressure but is trending lower and Mendes notes that rental inflation is softening.

Mendes didn't provide any hints on monetary policy but suggested that now measures of core inflation would remove mortgage interest costs he also highlighted the usefulness of multivariate core trend inflation, or MCT. He also said that Canada's 2% inflation target won't be changed.

"We’re planning to start publishing an interactive dashboard next year to house our broad array of inflation indicators. While we already do this to some degree, our new inflation dashboard will include more measures and be easier to use."

All that sounds like more ways for markets to get confused.