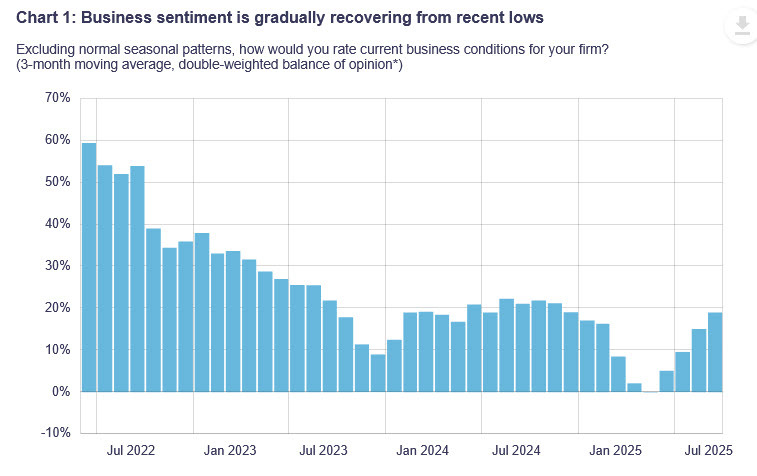

- Overall business indicator -2.28 vs -2.40 prior

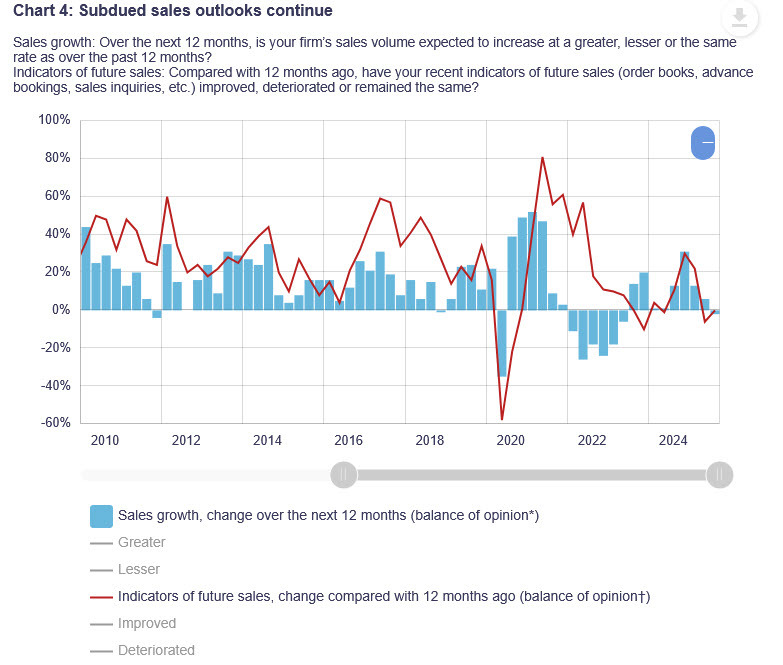

- Future sales 0 vs -6 prior

- 27% of firms saw an outright decline in sales over past 12 months vs 24% in Q2

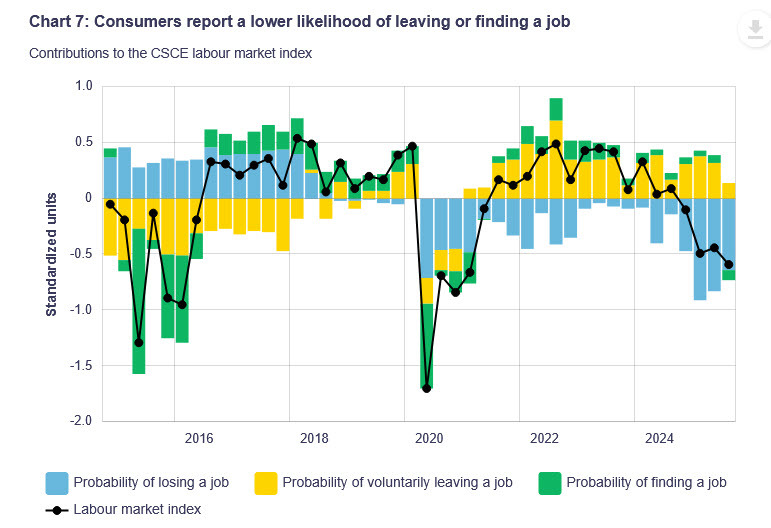

- Few firms reported binding capacity constraints or labour shortages, and most businesses do not expect to increase current staffing levels

- 35% of firms see lower labor costs in the coming 12 months, 14% see higher labor costs

- Firms see weak spending by business customers on services (such as renovations as well as corporate travel and events) and capital goods

- See weak outlooks in the housing sector

- Plans to expand capacity are on hold

- Share of firms that reported binding labour shortages fell to its lowest level since 2020

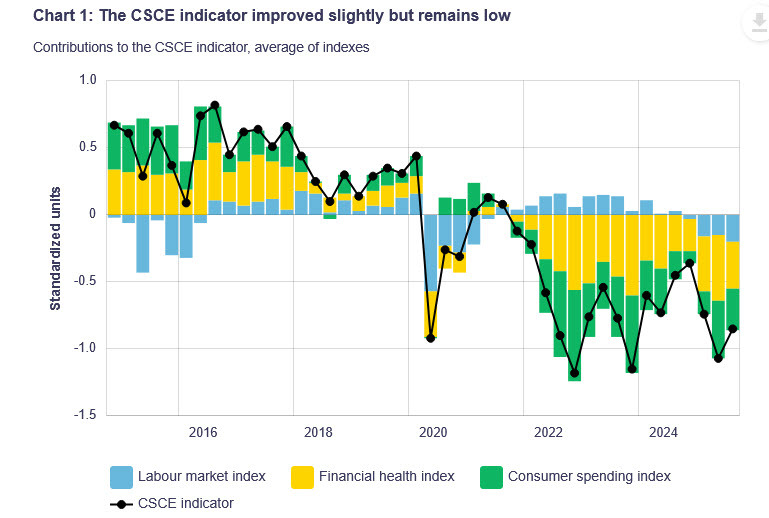

Survey of consumers:

- 64.1% of Canadians see a recession in the year ahead of 64.4% in Q2 survey

- Expectations for short-term inflation remain above their pre-pandemic averages, and expectations for longer-term inflation have picked up again

- Most consumers think the worst effects on the economy from trade tensions are still to come

The consumer survey was generally improved but only slightly and from poor levels.

Last week's comments from Bank of Canada Governor Tiff Macklem got surprisingly little traction as I thought he tipped his hand towards a rate cut at the end of the month. That probability has crept up to 84% but that's still too low.