The Atlanta Fed’s initial GDPNow estimate for Q1 2026 real GDP growth came in at 3.1% (annualized) as of February 20, pointing to a solid start to the year.

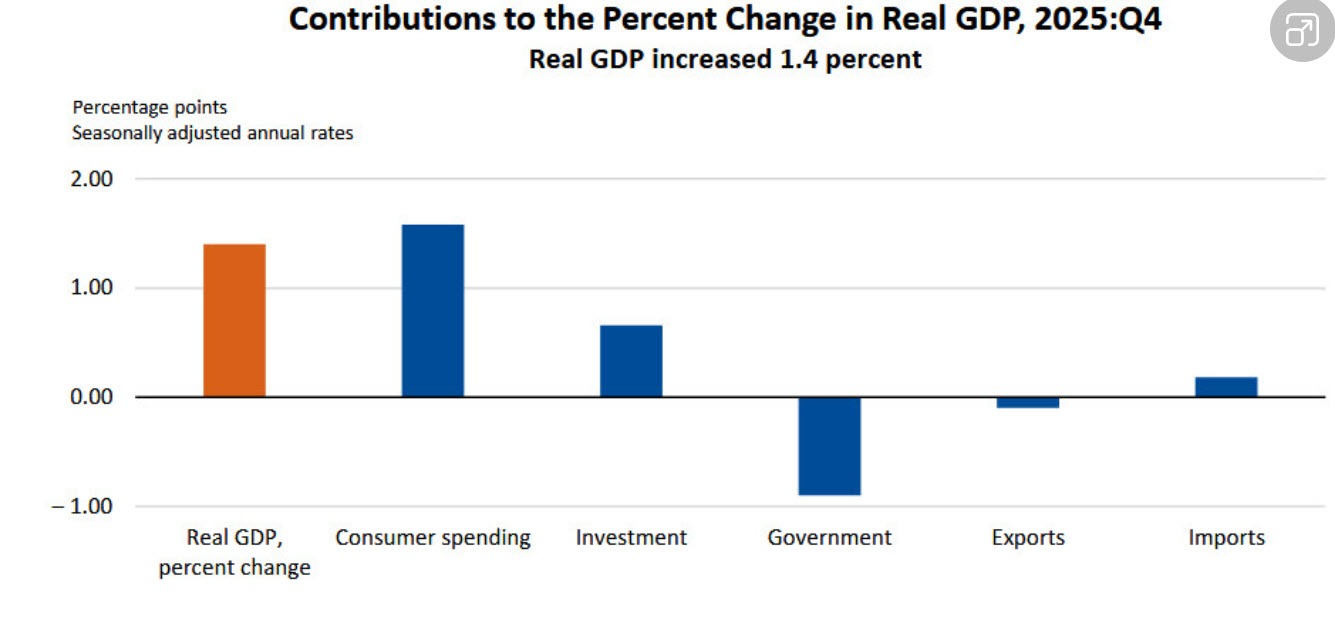

At the same time, the advance estimate for Q4 2025 GDP, released today by the Bureau of Economic Analysis, showed growth of just 1.4% — a notable downside surprise. That figure came in 1.6 percentage points below the final GDPNow nowcast for the quarter, and well under the Atlanta Fed’s earlier 3.0% forecast.

The miss wasn’t limited to the model. Economist expectations were also higher, with a Reuters survey showing estimates ranging from 1.5% to 4.2%, and an average forecast of 3.0%. The gap between the modeled and actual Q4 outcomes highlights the recent volatility in growth dynamics, even as early Q1 tracking suggests a potential reacceleration in economic activity.

In Q4 2025 U.S. GDP – Key Summary

Q4 real GDP (advance): +1.4% annualized

Q3 final GDP: +4.4% (sharp slowdown into Q4)

Consumer spending (PCE): +2.4%

Final sales to domestic purchasers: +1.2% vs +2.6% expected (weaker underlying demand)

Core PCE inflation: +2.7% vs +2.6% expected (firmer than forecast)

A visual of the contributions showed Consumers spending and investment added to growth but Government, and net trade were drags

Takeaways

Growth slowed markedly from Q3, weighed down by government spending and a sharp drop in the contribution from net exports.

Domestic demand (final sales) came in weaker than expected.

Core inflation ran slightly hotter than forecasts, alongside the December PCE data released simultaneously.

2025 full-year GDP growth: ~2.23%.