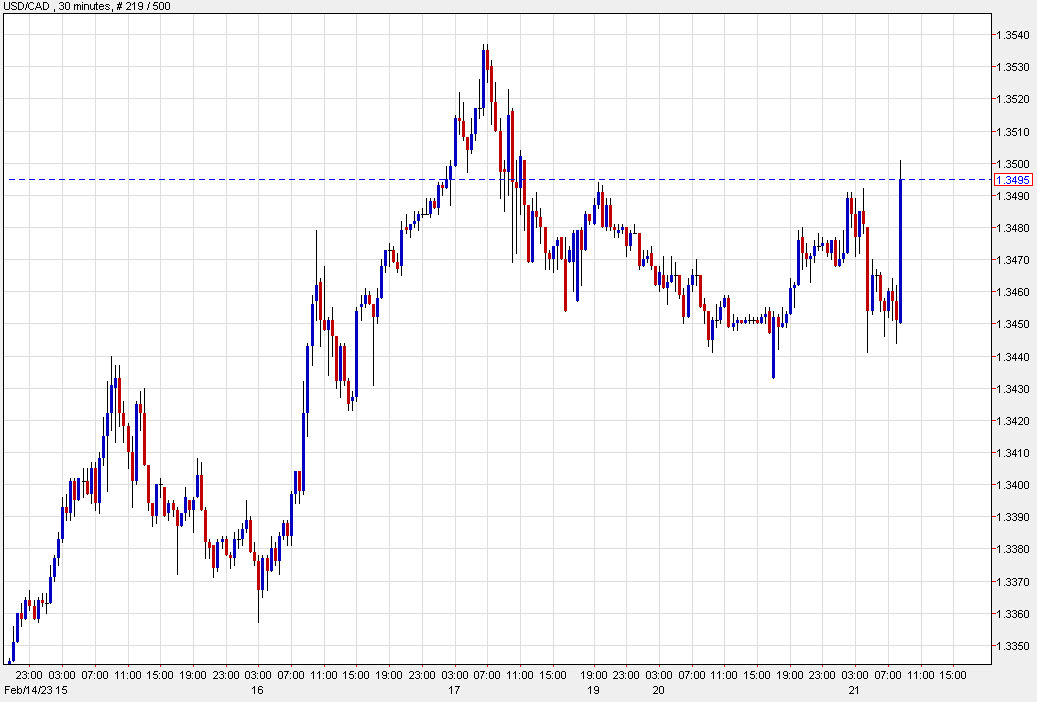

The Canadian dollar has fallen about 40 pips in the aftermath of today's data. Both CPI and retail sales undershot expectations and that's especially welcome news to the Bank of Canada.

Prior to the data, the market was flirting with the idea that the Bank of Canada's conditional pledge to hold rates steady wouldn't even last a single meeting. The implied odds of a hike at the March 8 meeting were 25% before the data in what would have been an embarrassing turn from the BOC just six weeks after their statement said:

If economic developments evolve broadly in line with the MPR outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases.

It's certainly far too early for Macklem to claim victory on inflation after a series of strong numbers, particularly jobs data. The next employment report isn't until two days after the BOC decision so this is the last major set of data. It likely buys them at least another month of data in the hopes that a cooling trend emerges. They may also get a look at the spring housing market and the potential for pain in that sector.

For the remainder of today's session, loonie traders will now turn to stock markets (S&P 500 futures -0.9%) and energy (oil up 57-cents) for a steer on trading.