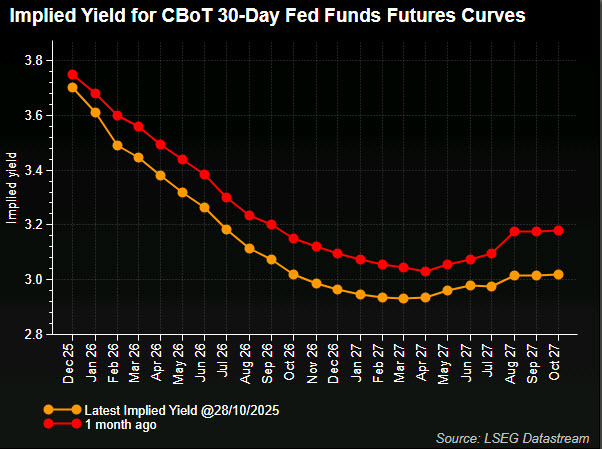

We are 30 minutes from the FOMC decision and the market is fully priced for a rate cut today. Less clear is what will happen next but the market sees a total of 112.7 basis points in easing through next December, including today.

Here is the current pricing:

Oct 29 2025: Implied Rate 3.858 | −24.4 bps

Dec 10 2025: Implied Rate 3.643 | −45.8 bps

Jan 28 2026: Implied Rate 3.518 | −58.4 bps

Mar 18 2026: Implied Rate 3.422 | −68.0 bps

Apr 29 2026: Implied Rate 3.358 | −74.4 bps

Jun 17 2026: Implied Rate 3.219 | −88.3 bps

Jul 29 2026: Implied Rate 3.143 | −95.9 bps

Sep 16 2026: Implied Rate 3.057 | −104.5 bps

Oct 28 2026: Implied Rate 3.013 | −108.9 bps

Dec 09 2026: Implied Rate 2.974 | −112.8 bps

Jan 27 2027: Implied Rate 2.958 | −114.4 bps

The Fed funds futures curve has moved lower in the last month despite record highs in stock markets and an evident US-China trade deal.

The risk today is that Powell indicates that December is more of a tossup than the 94% chance of a cut that's priced in. One way they could do that is by sounding a bit more upbeat on the jobs picture. My guess though is that he will keep his options open until we get a return of government data.