Odds of a rate hike jump, and not just in July

The odds of a Bank of Canada rate hike in July jumped to 79.5% from about 50% on the heels of the BOC statement. The big development was the removal of the word 'cautious,' which is a dead giveaway that the BOC plans to hike at the next meeting on July 11.

What's likely to have a more long-lasting effect on the currency is a line saying the BOC will take a "gradual approach" on rates in a shift from the previous language saying "higher interest rates will be warranted over time."

It can't be a coincidence that the BOC is using the same language as the Fed, which has used 'gradual' to indicate hikes at every second meeting. That would put a BOC hike on the table in October. The odds for that meeting have risen to about 60% and then you have to keep going down the line and pushing up the rate hike path.

That's what is underway at the moment and it will be a tailwind for the Canadian dollar for at least a few more days.

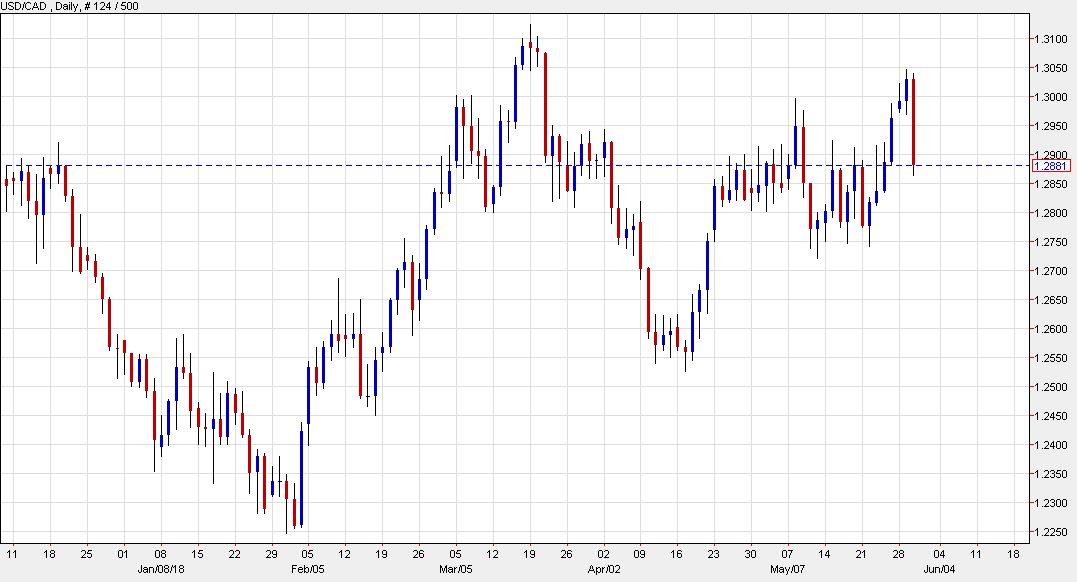

Expect a slide down to 1.2750-75 in the near term.

The main risk in the day ahead is GDP. The BOC said in the statement that Q1 growth was a bit stronger than they expected but the BOC forecast is just 1.3%. The economist consensus is already 1.9% so that doesn't signal a reading that's necessarily a tailwind for the loonie but there will be something in it the market might like. The statement hints at strong exports and consumer spending.

The other event to watch is a speech from the BOC's Leduc in Quebec at 12:50 ET. The speech is part of the BOC's communication strategy to tweak the message after the statement, if needed. It could be a major market mover.