Hola Prime Markets

- Minimum Deposit 0-50

- Leverage 2000:1

- Regulation FSC

Hola Prime Markets Review 2026 | All You Need To Know!

Introduction

Hola Prime Markets is a forex and CFD broker based in Mauritius and operated by Hola Prime Ltd. The broker provides access to forex, indices, commodities, cryptocurrencies, and stock CFDs and makes these markets available on MetaTrader 4, MetaTrader 5, and the Hola Prime Markets App. On its pages it highlights fast order execution, micro-lot trading from 0.01, 20% stop-out and leverage of up to 1:2000, while some trading-condition sections show more conservative limits per instrument.

Clients can choose between several live accounts typically Standard, VIP, and a Raw-spread a/c with option to select Swap free trading with a low starting deposit from around $40 on the basic accounts and a higher requirement on the raw-spread & VIP account. That positions the broker in the more accessible, offshore segment rather than in the strictly capped EU/UK environment.

Overall, Hola Prime Markets presents itself as a multi-asset MT4/MT5 broker for international traders, with extra services such as PAMM/MAM, VPS, and bonus promotions visible in the navigation.

In this review of Hola Prime Markets, we will look at the broker’s regulation, trading platforms, tradable instruments, account conditions, pricing/deposits, and customer support, so traders can judge whether the offering matches their trading profile and risk tolerance.

Regulation & Safety

Hola Prime Markets states that its services are provided by Hola Prime Ltd, a company registered in Mauritius and authorised by the Financial Services Commission (FSC) of Mauritius as an Investment Dealer (Full Service Dealer, excluding underwriting) under license number GB24203729. This is the broker’s primary regulatory reference and the basis on which it offers its trading services.

Being regulated in Mauritius places the broker in the offshore / international category rather than in the more stringent European or UK frameworks. In practice, this means traders get a supervised entity, but they do not get the same style of investor-compensation schemes or detailed client-money disclosures that are common under FCA, CySEC, or ASIC regimes.

The broker’s legal and footer sections also include:

a standard risk warning about leveraged products,

and a list of restricted jurisdictions (the broker says it does not accept clients from certain countries such as the United States and other high-risk or sanctioned locations).

There is a mention of segregation/availability of client funds for withdrawals, but the broker does not publicly name specific banks or custodians. Because of that, Hola Prime Markets should be viewed as a regulated offshore broker: there is an identifiable company and license, but disclosure is kept at a high level.

Trading Platforms

Hola Prime Markets offers a standard MetaTrader setup supported by its own mobile application. This will suit traders who are already familiar with MT4/MT5 environments and want to keep charting, EAs, and order types consistent across accounts.

Available platforms:

MetaTrader 4 (MT4): classic desktop/mobile/web platform, suitable for forex and CFD trading, supports EAs and custom indicators.

MetaTrader 5 (MT5): the broker highlights MT5 as the more complete option, with additional timeframes, more built-in tools, and the ability to view/use a wider instrument list (indices, stocks, commodities, crypto) from one place.

Hola Prime Markets App: for mobile trading, deposits/withdrawals, and account management on the go. This is positioned as the broker’s own way to access the same instruments from phone/tablet.

What traders can do on these platforms:

open/close and modify orders on all the listed asset classes;

trade from 0.01 lot on supported symbols;

monitor market prices and account balance in real time;

use technical indicators and drawing tools (MT5 page notes 21 timeframes and 80+ tools).

Markets & Instruments

Hola Prime Markets positions itself as a multi-asset CFD broker. All instruments are made available from one trading account on MT4/MT5 or the Hola Prime Markets App, so traders don’t need to open separate accounts for each asset class.

Forex: the broker says clients can trade “1000+ instruments” ,“100+ currency pairs” and 1000+ global stocks in the FAQ/markets sections. This suggests a wide list covering majors, minors and several exotics. Forex is clearly the core product.

Commodities & metals: gold, oil, Palladium, silver and other popular contracts are listed under the global markets page. These are typical CFD products for intraday trading.

Indices: major US, European and Asian indices such as S&P 500, Nasdaq, Dow Jones, JPY225, DAX are specifically named. These are offered as CFDs for directional trading.

Cryptocurrencies: BTC, ETH, LTC, XRP and “a growing list of cryptocurrencies.” Crypto is the only asset the broker explicitly says can be traded 24/7.

Stock CFDs: examples given are “Apple, Google and more,” indicating single-stock CFDs on well-known names rather than physical share dealing.

Trading hours and access:

Most instruments follow 24/5 FX/CFD market hours.

Cryptocurrencies are available 24/7, which the broker mentions in the markets FAQ.

Leverage on instruments:

On the markets page the broker talks about “flexible leverage” and gives 1:2000 as the maximum leverage.”

In the account/FAQ section, the broker says it offers up to 1:2000 on all account types. Because both numbers appear on the site, traders should expect leverage to be capped by instrument and possibly by equity or jurisdiction.

Account Types

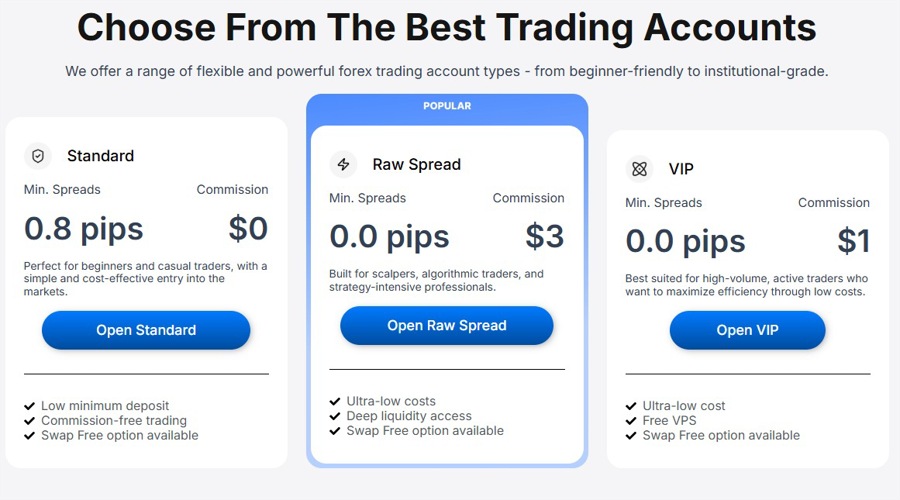

Hola Prime Markets groups its live accounts into tiers aimed at different deposit sizes with swap free option available with all tiers. The public Account Types page shows the same core features across all accounts (MT4/MT5 access, fast funding, no “hidden” fees on deposits/withdrawals), and then adjusts spreads, commissions and minimum deposit by tier.

Standard Account

Minimum deposit: around $40 (entry level mentioned in the broker materials)

Spreads: from about 0.8 pips on major FX, variable

Commission: none stated for this tier

Leverage: (up to 1:2000 for smaller accounts and changes with equity., so the effective cap will depend on instrument/equity)

Suitable for: new/live traders who want the lowest entry point

VIP Account

Minimum deposit: same as Standard ($5000)

Spreads: can start from 0.0 pips on majors

Commission: a small trading commission of $1 per lot/per side is charged on most instruments.

Suitable for: Traders who value cost efficiency and Volume trading

Platform: MT4/MT5

Raw / Zero-Spread Style Account

Minimum deposit: from $100

Spreads: can start from 0.0 pips on majors

Commission: a standard trading commission is usually applied on this tier (the Trading Conditions page talks about 0.0 pips via aggregated LPs, which is typical of commission accounts)

Suitable for: active traders looking for tighter pricing

Shared features across accounts

Access to MT4, MT5 and the Hola Prime Markets App

Instant deposits and fast withdrawals per the accounts page

Micro-lot (0.01) trading

Same pool of forex, indices, commodities, crypto and stock CFDs

Eligibility to use extras such as PAMM/MAM and VPS shown elsewhere on the site

Important note on leverage: the broker publishes different ceilings as per an account up to 1:2000.Traders should expect the leverage to be set according to the account's equity and instrument.

Deposits & Withdrawals

Hola Prime Markets keeps the funding part fairly simple and pushes the message “no hidden charges on withdrawals” on its main pages. It also says it reimburses deposit fees, which is a typical offshore-broker incentive.

Funding methods (from broker sources):

Bank / online payment channels

Crypto rails (the broker elsewhere references BTC/ETH/USDT/USDC-type funding)

Broker-side processing through the client dashboard (login area)

Fees:

The site states: “We do not charge any fees for deposits or withdrawals.” That means Hola Prime Markets is positioning funding as zero-fee on its side, but traders should still expect possible charges from their own bank/wallet.

Processing & availability:

Deposits are intended to be instant/fast so traders can start trading immediately.

Withdrawals are described as available and “readily” processed in 1-hour.

Bonuses and funding links:

There is an active 15% welcome bonus tied to a first deposit, with a max bonus of $1,000 and the condition that the client must contact support after depositing. That confirms deposits are fully integrated with support and promotions.

Customer Support & Extra Services

Hola Prime Markets puts a lot of emphasis on being reachable. The Contact Us page lists 24/7 support by live chat, phone and email, with a UK phone line and a dedicated support mailbox. This matches the messaging repeated in the footer and FAQ sections. Traders can therefore expect to reach the broker at any time, which is important given it also offers 24/7 crypto trading.

Support channels:

Live chat (24/7)

Email: contactus@holaprimemarkets.com

Phone: +44 line shown on the contact page

FAQ centre with categories for platforms, PAMM/MAM, funding, and company info

Alongside support, Hola Prime Markets promotes several value-add services:

PAMM/MAM: the broker offers managed-account infrastructure for money managers and investors. Money managers can charge performance fees and also receive IB commissions, while investors can monitor performance in real time and keep control of their funds. This is a typical feature among offshore MT4/MT5 brokers and is useful for traders who want to attract clients.

Free VPS / Promotions: the promotions area mentions a free VPS and deposit bonuses, which are usually tied to minimum deposit or trading-volume requirements. These incentives are common with offshore brokers.

Community / Discord: the site invites traders to join its Discord community, which suggests the broker is trying to build an ongoing client base around its services.

Hola Prime Markets Pros and Cons

Advantages | Disadvantages |

MT4 and MT5 both available, plus the broker’s own mobile app. | Offshore/Mauritius regulation – not the same protection level as EU/UK/AU. |

24/7 customer support with phone, email and live chat. | |

Extra services for active clients and IBs: PAMM/MAM, copy trading, VPS, bonuses. |

Conclusion

Hola Prime Markets is built as an offshore, high-access MT4/MT5 broker: low minimum deposit, wide CFD coverage, headline high leverage, and a set of add-ons (PAMM/MAM, copy trading, VPS, bonuses) aimed at traders and money managers who want more than just a basic trading account. The company does publish its Mauritius authorization and license number, so there is a defined entity behind the website.

At the same time, the disclosure level stays at what you would expect from a Mauritius-licensed broker, there is no investor-compensation scheme shown, no detailed list of custodial banks, and the leverage messaging is not 100% consistent across pages.

For traders who are comfortable with offshore setups, want MT4/MT5, and like having extra services and 24/7 support, Hola Prime Markets fits that profile. Traders who prioritise EU/UK-style protections or strictly harmonised leverage rules will likely look for a broker regulated in those jurisdictions instead.

Frequently Asked Questions

Is Hola Prime Markets a regulated broker?

Yes. Hola Prime Markets says it operates as Hola Prime Ltd and is authorised by the Financial Services Commission (FSC) of Mauritius under an Investment Dealer (Full Service Dealer, excluding underwriting) licence. This is an offshore licence, not an EU/UK one.

Where is Hola Prime Markets based?

The broker is based in Mauritius and provides its services internationally, except to a list of restricted/sanctioned countries mentioned in its legal/footer sections.

What platforms does Hola Prime Markets offer?

Clients can trade on MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the broker’s own Hola Prime Markets App. MT4/MT5 are suitable for forex and CFD trading, EAs and technical analysis.

What can I trade with Hola Prime Markets?

The broker lists forex, commodities, indices, cryptocurrencies and stock CFDs. This is a CFD/speculative setup, not a physical-share or investing account.

What is the minimum deposit?

The entry-level accounts (Standard / Swap-Free) start from about $40, while the raw/low-spread account requires around $100.

What leverage does Hola Prime Markets offer?

The broker mentions leverage up to 1:2000 on smaller accounts and varies with account equity level.. Actual leverage depends on the account’s equity and instrument, , so traders should confirm it in the client area before trading.

Does Hola Prime Markets have Islamic / swap-free accounts?

Yes. A swap-free option is listed with all a/c types- Standard, VIP and Raw-Spread t for clients who cannot pay or receive overnight interest.

What account types are available?

Typically three:

Standard (no commission, variable spreads)

VIP(very low commission, tight spreads)

Raw / low-spread (tighter spreads, higher minimum deposit, commission)

How can I deposit and withdraw?

Funding is done through the client area and the broker says it reimburses deposit fees and does not add “hidden charges” on withdrawals. Exact methods (bank/online/crypto) and processing times should be checked in the dashboard before sending larger amounts.

Does Hola Prime Markets accept clients from every country?

No. The site states it does not offer services to residents of some countries, including the United States and other high-risk/sanctioned jurisdictions.

Is copy trading or PAMM/MAM available?

Yes. The broker promotes PAMM/MAM, copytrading and VPS as additional services, mainly for active traders, money managers and IBs.

Is Hola Prime Markets safe to trade with?

It has a disclosed company and licence in Mauritius and publishes standard policies. However, because this is an offshore licence, it does not offer the same investor-protection level as FCA/CySEC/ASIC brokers.

Nike downgraded, but BofA upgrades Coinbase to Buy! Goldman Sachs revises crypto stock target. Traders eye sector shifts.

Copper futures rally ~0.10 on strong volume, with Mar '26 contracts leading gains. Watch for continued upward momentum.

Soybeans rally! Mar '26 futures up 4.50 to 1065.75, volume picks up. Traders eye continued upward momentum.

Rice futures dip slightly; March contract down 0.3% on lower volume. Traders eye open interest shifts.

Cotton futures see mixed action; March '26 contract dips 0.09 to 64.37, volume down.

Crude oil contracts surge over $1.40, with Feb '26 leading gains. Traders eye rising volume and open interest.

Truckload stocks surge ~40% on tight supply; demand needed for sustained upcycle. Analysts eye 2026 recovery.