Fundamental strategy

7 pharma stocks from EuropeFX you need to know for a Covid-19 vaccine

Qualcomm stock is making the biggest moves: Will the rally continue?

Gold rush: Why the precious metal is trading at all-time highs

A bit more detail on QE and currency prices

Gold caps off dramatic first half of 2020: Where is the precious metal headed in H2?

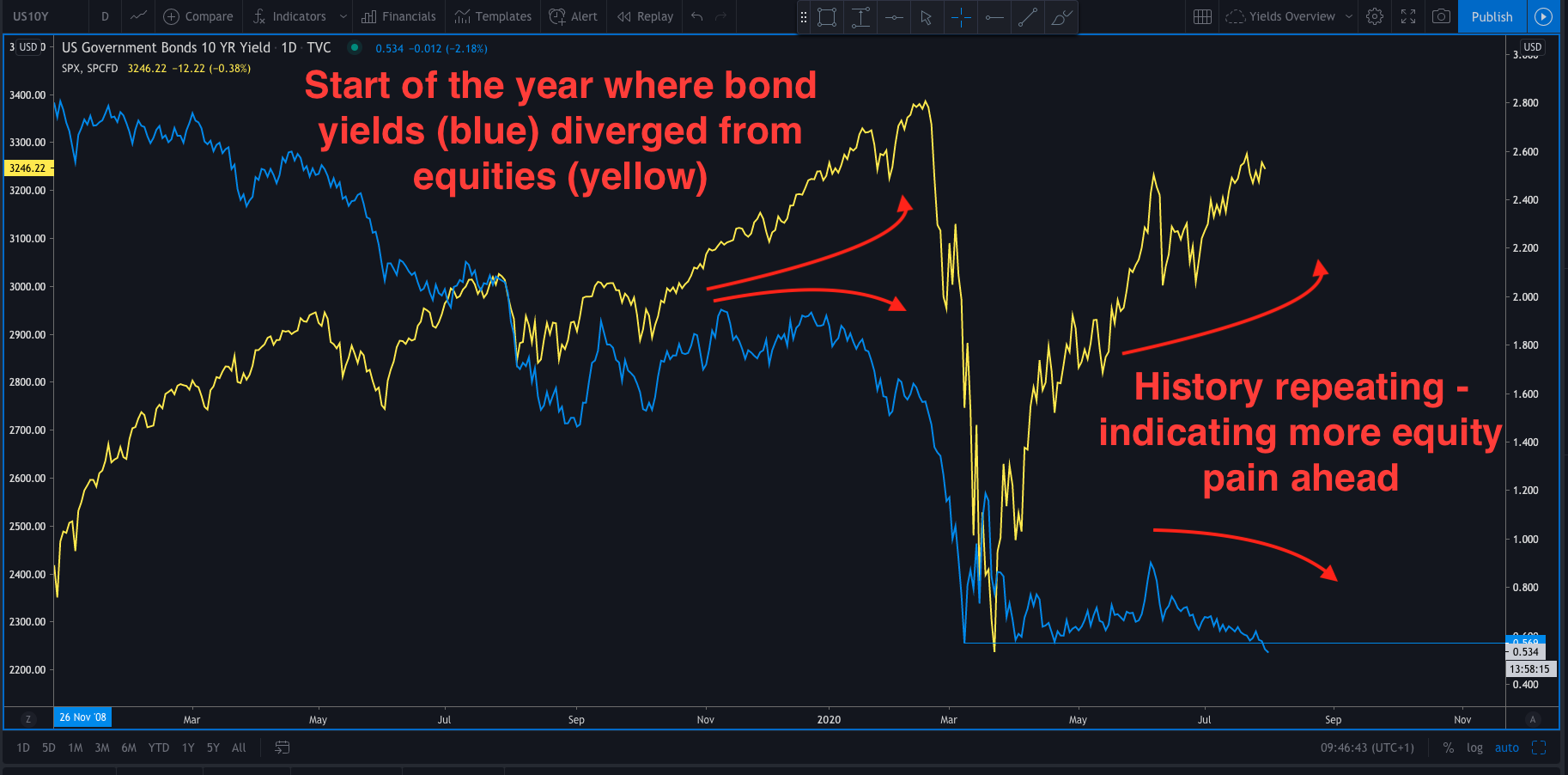

What is driving risk appetite in the financial markets?

Why all the recent talk about LIBOR and SOFR?

With the Nasdaq at record highs, can tech stocks reboot the US economy?

Stagflation fears rise as Iran conflict boosts oil prices, paralyzing Fed rate cut hopes. Bond yields climb.

Gold's 74% yearly surge offers hedge potential, but watch its high valuation & historical volatility.

Amazon's $427M GWU campus buy fuels data center race. Local pushback signals potential valuation risks.

UK gas reserves hit 1.5 days, traders charge premium. Oil prices may surge past $100.

CEE M&A hits record €42.5bn! Deals up 36% as larger transactions signal confidence, despite fewer deals.

$40 smartphones aim for 20M new users, but rising memory costs and thin margins pose risks.

Cocoa futures crash from $12k to $4k/ton! Farmers abandon farms for gold, risking fertile land for quick cash.

Must Read