Forex options, orders & fixes

In finance, a foreign exchange option (commonly shortened to just the FX option or currency option) is a derivative financial instrument that gives the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date.

The foreign exchange options market is the deepest, largest, and most liquid market for options of any kind.

Most trading is over the counter (OTC) and is lightly regulated, but a fraction is traded on exchanges like the International Securities Exchange, Philadelphia Stock Exchange, or the Chicago Mercantile Exchange for options on futures contracts.

The global market for exchange-traded currency options was notionally valued by the Bank for International Settlements at $158.3 trillion in 2005

In finance, a foreign exchange option (commonly shortened to just the FX option or currency option) is a derivative financial instrument that gives the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date.

The foreign exchange options market is the deepest, largest, and most liquid market for options of any kind.

Most trading is over the counter (OTC) and is lightly regulated, but a fraction is traded on exchanges like the International Securities Exchange, Philadelphia Stock Exchange, or the Chicago Mercantile Exchange for options on futures contracts.

The global market for exchange-traded currency options was notionally valued by the Bank for International Settlements at $158.3 trillion in 2005

Why Do Retail Forex Traders Lose Money?

- Several factors are responsible for these losses.

Chart Patterns Guide

- Chart patterns can help you timing technically your entries and exits.

Trading Tip: How to Filter Out the Noise

- It’s best to look at three key things to filter out the noise.

Why Retail Traders Fail?

- Most traders actually lose money and a very little percentage become successful.

Inceptial - Geared to Development

- Inceptial offers a fully customizable and user-friendly trading platform that can satisfy every client's needs.

What Makes a Successful Forex Trader?

- An individual should know how to speculate on currency market prices, intending to generate profits.

Should you prefer held orders when they restrict the broker?

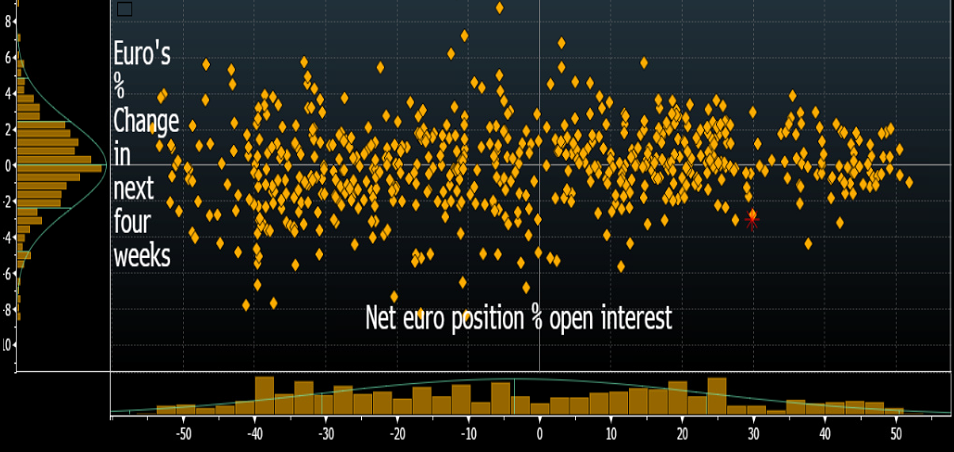

Why traders care about non-commercial COT data

How does QE impact commercial banks rates?

Context is everything when it comes to CFTC positioning data

Gulf oil output halts amid Strait of Hormuz closure. US offers subsidized insurance. Oil prices surge 60% YTD.

Middle class shrinks as housing costs soar 117%. Wages lag, making stability a distant dream for many.

Jobs data dips, oil spikes! Fed's stuck between inflation & unemployment.

Mortgage rates climb to 5.98% on inflation fears. Shorter terms offer lower rates but higher payments.

PA lawmakers probe gas price gouging as prices jump 14% amid supply fears. High risk, high return?

Paramount's $18B WBD bid beats Netflix. Traders eye sports strategy shifts & CNN's future.

Roche's pharma unit's tariff-free, but diagnostics face renewed duties. Sales hit!

Must Read