Economics

Are demand management policies the solution or a mass delusion?

The many meanings of "liquidity": More from guest economist John Hearn

Think you know everything about oil? Think again: "New economics of oil"

Interest rate policy - Solution to crisis or its cause?

Decades of mistakes from the BOE. What can we learn?

RPI vs CPI: What's the best measure of inflation ?

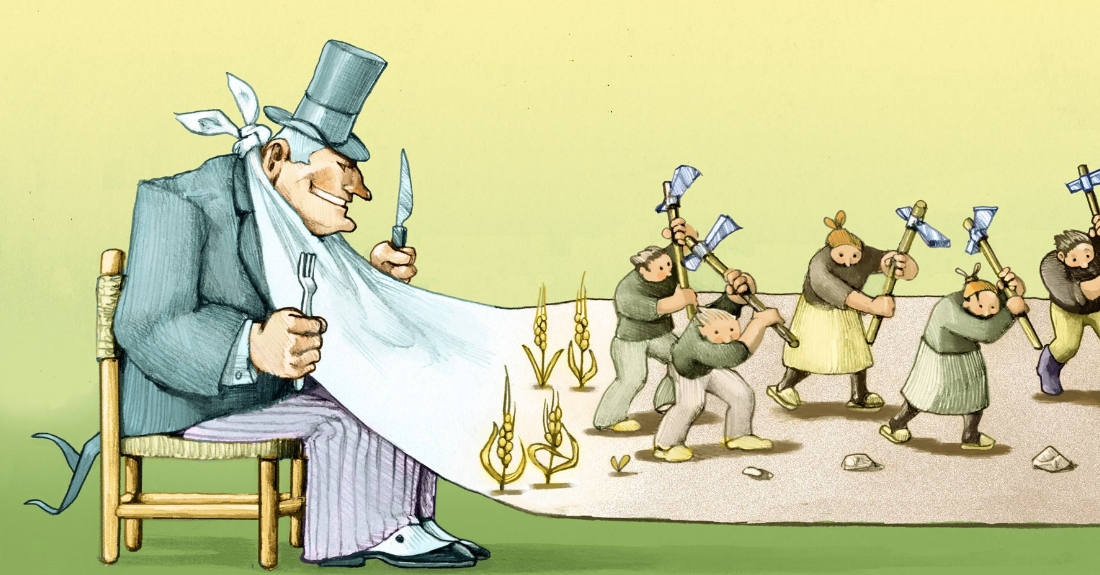

Equality or inequality? - More from guest economist John Hearn

Deflation: An abject failure in the BOE's monetary policy

Sugar futures see mixed action; March '26 contract dips to 14.95, volume down. Traders eye price swings.

Corn futures (Dec '25) dip 0.50 to 499.50, while soybeans (Aug '26) rally 2.40 to 307.40. Traders eye volume shifts.

Gold futures dip $50.60 on Dec contract, volume down 30%. Traders eye inflation risks and Fed policy.

Corn futures dip: Dec '25 contract down 3.75 to 424.25. Volume slumps, open interest rises.

Wheat futures dip slightly (-$0.015 to -$0.0225) on mixed volume. Traders eye Dec '25 at $5.10.

Copper futures dip slightly, with Dec '25 down 0.0275. Watch Sep '26 for a bullish breakout above 5.2930!

Investors flee AI hype for next-gen winners, mirroring dotcom era. Nvidia's $4T valuation sparks caution. Traders eye undervalued tech.

Top Brokers

Sponsored

Must Read