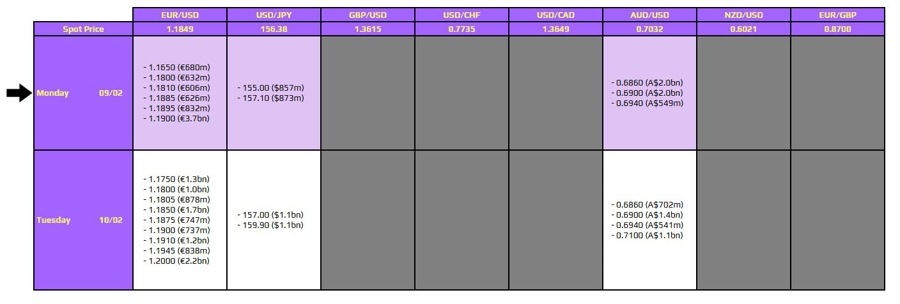

There are some chunky expiries that stand out on the day but none of which are likely to be of any impact. The full list can be seen below.

There are some large ones for EUR/USD and AUD/USD in particular, holding at the 1.1900 and 0.6900 levels respectively.

The former is the most likely to be of any note, with the dollar weakening across the board as broader market sentiment picks up again after a rocky mood last week. Precious metals are back on the up and risk sentiment also bounced back on Friday with some steadier signs today.

The expiries don't tie to any technical significance, so it could just act on its own as a ceiling for price action. That is if we see a material dollar drop in the session ahead. In that lieu, do keep an eye out for USD/JPY as intervention risks are now as high as ever after the weekend election in Japan. It feels like a case of any time now for Tokyo to step in.

As for the larger expiries in AUD/USD, they should not factor into play given what we're seeing with price action currently. So, I wouldn't attach much significance to that; all else being equal in markets.

For more information on how to use this data, you may refer to this post here.

Head on over to investingLive (formerly ForexLive) to get in on the know!