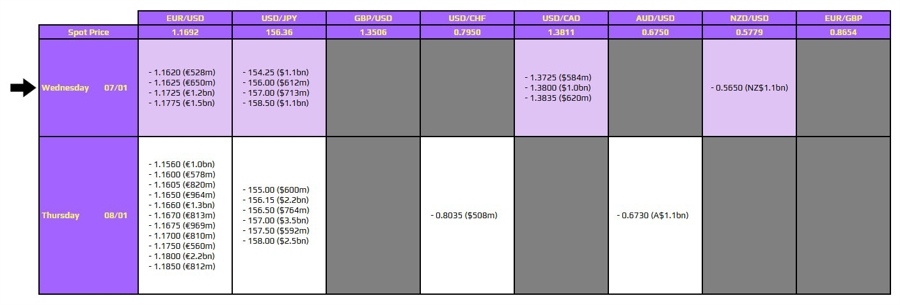

There are some large expiries on the board for the day but they may not have all too much impact on price action. Let's take a look with the full list seen below.

The first one is for EUR/USD at the 1.1725 level but the pair looks to be consolidating closer to 1.1700 after the overnight drop, which came after a bounce off the 100-day moving average on Monday. The key level is still seen at 1.1663 so that will provide a floor for price action ahead of the US jobs report while upside is more limited by the key hourly moving averages. The 100-hour moving average is at 1.1717 with the 200-hour moving average at 1.1747. So, that will help put a lid on things until we get key headlines to really break the shackles to start the year.

Then, there is one for USD/CAD at the 1.3800 level. However, the expiries don't tie to any technical significance so I would not attach much substance to the potential impact in drawing price action. The pair is very much still continuing a bounce since late December with eyes on the 200-day moving average at 1.3848 currently.

For more information on how to use this data, you may refer to this post here.

Head on over to investingLive (formerly ForexLive) to get in on the know!