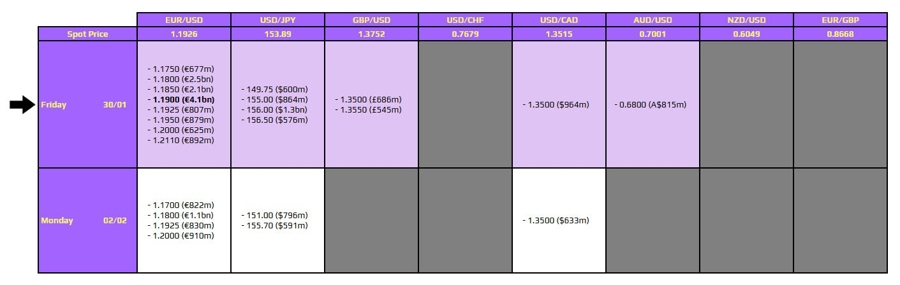

There is arguably just one to take note of on the day, as highlighted in bold below.

That being for EUR/USD at the 1.1900 level. The expiries don't tie to any technical significance but are resting just under the 100-hour moving average of 1.1935 currently. The pair is finding a bit of a push and pull in trying to keep above 1.1900 with bids layered there too during the week, so the expiries will add another layer in defending that.

However, dollar sentiment remains the main driver at the moment. And that will largely be affected by the action in precious metals. As gold and silver are down and may be poised to correct further, that will invite dollar shorts to be covered as well. As such, the impact of the expiries will be lesser when accounting for this key factor driving trading sentiment currently.

There are other large ones at 1.1800 and 1.1850 which could come into play, that is should the dollar jump much higher if we do see a much sharper decline in both gold and silver. That also as risk sentiment starts to get rocked by the profit-taking and volatility in precious metals.

So, just keep that in mind as that is the bigger thing to watch out for in not only commodities but also major currencies at the moment. You have to keep your eye on what is happening with gold and silver to have a gauge of the spillover impact towards the dollar and the rest of the FX space.

For more information on how to use this data, you may refer to this post here.

Head on over to investingLive (formerly ForexLive) to get in on the know!