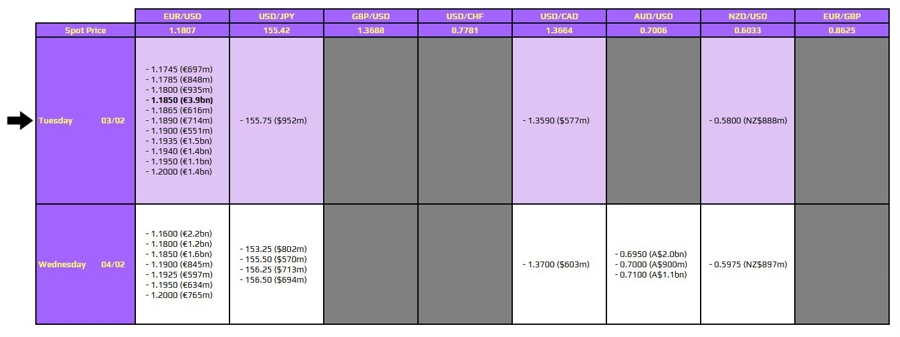

There is arguably just one to take note of on the day, as highlighted in bold below.

That being for EUR/USD at the 1.1850 level. It's not one that ties too closely to any key technical levels but could help to limit upside extensions later on in the session, if any. The pair has been trending lower this week, now falling back below both its key hourly moving averages. The 200-hour moving average now is the closest at 1.1865, so keep below that and the near-term bias stays more bearish.

So, the expiries could just add another layer nearby on any price spikes depending on the overall market mood. But for now, it's all about dollar sentiment being the bigger driver of price action more than anything else.

The greenback has recovered modestly amid the selloff in precious metals but we're seeing a bit of a breather in the latter now. So, that's keeping traders on edge a little in figuring out the next move. It won't be helped of course by yet another delay to the US non-farm payrolls data release amid the US government shutdown. Oh, what fun.

For more information on how to use this data, you may refer to this post here.

Head on over to investingLive (formerly ForexLive) to get in on the know!