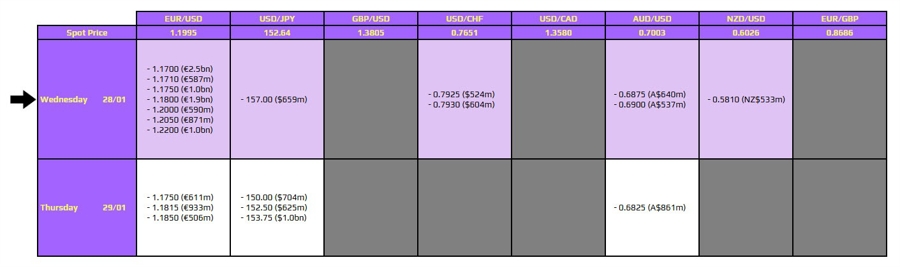

Once again, there aren't any major expiries to take note of on the day with the full list seen below.

There are some large ones for EUR/USD but they are too far away to be of any impact. The central bank bonanza is back in town with the Bank of Canada and Federal Reserve decisions coming up later today. So, those will be the more important drivers of trading sentiment in the day ahead - especially the latter.

As an aside, just be wary that we could get to hear from Trump on his pick of Fed chair after the central bank decides on policy today. It would be quite timely for him to make such an announcement, so just be wary of that.

So far today, the dollar is bouncing back a little but the gains are nothing to shout about after the heavy declines yesterday. Trump piled on more pressure on the greenback after saying that "the dollar is doing great" and that "I don't think the dollar has declined too much". Amid his push for tariffs and what not, a weak dollar is something he favours a lot to boost the US' export capabilities and competitiveness.

As such, making such an endorsement is only going to keep piling on the pressure on the dollar in the medium-term. That unless the erratic nature of the US administration and uncertain policy handling changes. Not to mention the pressure from Trump himself towards the Fed in wanting lower interest rates.

For more information on how to use this data, you may refer to this post here.

Head on over to investingLive (formerly ForexLive) to get in on the know!