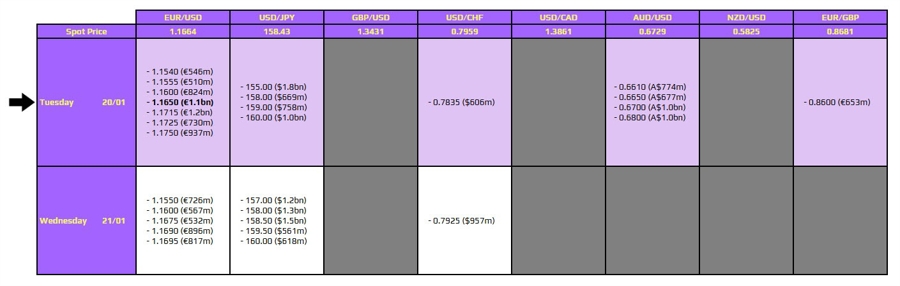

There is arguably just one to take note of on the day, as highlighted in bold below.

That being for EUR/USD at the 1.1650 level. It's not one that ties to any technical significance, so the impact of the expiries may be more limited. The dollar remains weak overall amid the whole Greenland situation, with traders punishing the greenback on more chaotic and erratic policy by the US administration.

The 200-hour moving average sits at 1.1644 with the 100-day moving average at 1.1661. Those will be the more critical levels to be mindful of just in case we do see some pushing and pulling in price action in European morning trade.

The expiries will just add a bit of layering to the key technical levels above but it's all about traders defending the lines there that will matter more. In my view, the push back above the key hourly moving averages is a big step this week.

Buyers are back in near-term control for the first time since the end of last year. As such, defending that 200-hour moving average line is a vital action in keeping a more bullish near-term bias. There was a bit of a struggle overnight and in early Asia trading to break above it but we're now taking that in stride as the dollar continues to struggle today.

For more information on how to use this data, you may refer to this post here.

Head on over to investingLive (formerly ForexLive) to get in on the know!