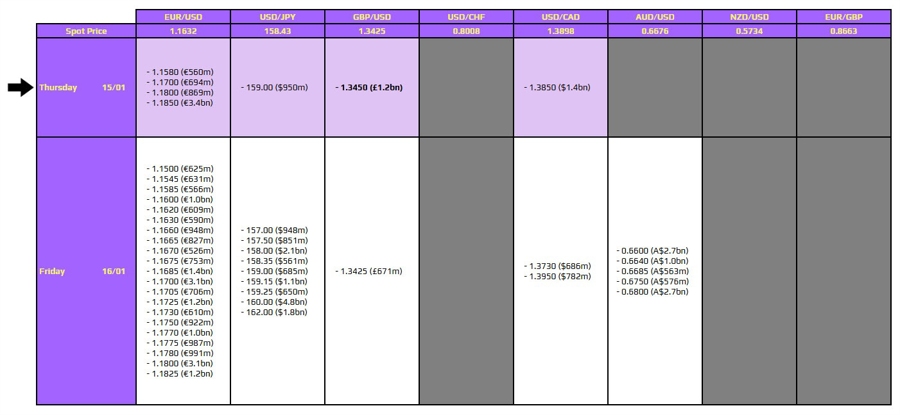

There is arguably just one to take note of on the board for the day, as highlighted in bold below.

That being for GBP/USD at the 1.3450 level. It isn't one that might factor into play but if we do see an upside extension to the daily range in the session ahead, the expiries could pair with key near-term levels to limit any push higher. The 100-hour moving average sits at 1.3440 currently with the 200-hour moving average seen at 1.3461. The latter helped to hold gains in overnight trading before a light dip into trading today. But in terms of impact, that seems to be the extent of it for the expiries here.

Looking to tomorrow though, there will be more interesting fish to fry. There are large expiries for EUR/USD closer to the 1.1700 mark, so keep a watchful eye on that just in case.

However, the more interesting one might be the huge one for USD/JPY at the 160.00 level. Now, Tokyo officials have come out with some verbal intervention and that is keeping the upside surge in check since the tail end of Asia trading yesterday. As intervention risks rise, that's holding off bullish speculators from pushing for another run up in the pair.

So, the expiries at 160.00 might not factor into play but just be mindful of them if we do start to probe for another move above 159.00 when we approach Asia trading tomorrow. The expiries could provide a draw in pulling price over the line if we do see price action keep close enough in the day ahead.

For more information on how to use this data, you may refer to this post here.

Head on over to investingLive (formerly ForexLive) to get in on the know!