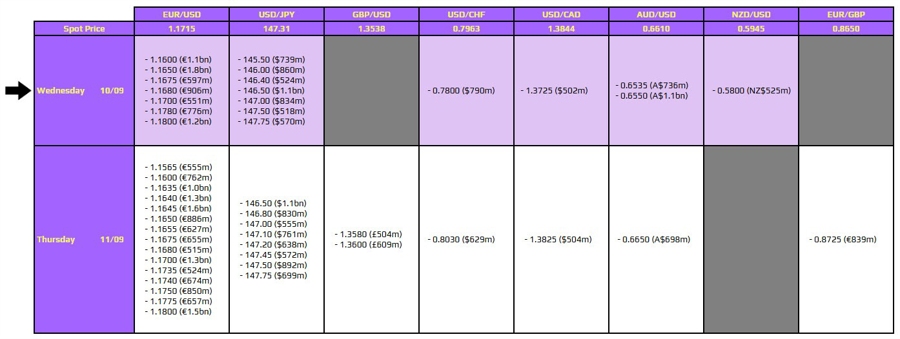

There aren't any major expiries to take note of for the day, with the list seen below.

After the largest downwards annual revision on record to US jobs yesterday here, it just continues to reaffirm the narrative that the Fed should move faster to cut rates. Still, it's not enough to trigger a spark for traders to price in a 50 bps move next week. The onus on that will fall on the US CPI report tomorrow it would seem; provided the inflation numbers are softer than anticipated.

The dollar remains in a more tentative and vulnerable spot, but not facing another bout of selling just yet. The lack of expiries today will be accompanied by a lack of key economic releases in Europe, so that will keep things quieter in the session ahead.

That said, just be wary of potential geopolitical headlines that could stir things up. The Israel-Qatar situation yesterday was one before we got a new development in the Russia-Ukraine conflict here.

For more information on how to use this data, you may refer to this post here.

Head on over to investingLive (formerly ForexLive) to get in on the know!